Navigating tomorrow today: Scenario analysis for financial sector boards

Board summary

"In recent board discussions with our Sustainability team, it has been clear that conversations are moving from compliance-based sustainability actions to sustainable strategy implementation. There is a clear shift in narrative towards opportunity and long-term business modelling. Key to NEDs’ active participation and influence is keeping the modelling and analysis focused on the points which are really material to strategy."

- Non-executive director, international bank

Getting scenario analysis right in the boardroom is crucial to resilience now and in the future

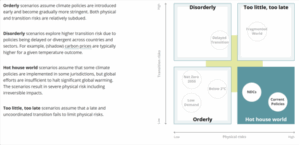

It is 2030. In the previous 5 years, climate policy has faltered, decarbonisation activity has slowed and, ultimately, CO2 levels haven’t decreased substantially. Temperatures have reached 1.5°C (above pre-industrial levels) and are being predicted to rise to 1.8°C, and possibly higher, in the coming decades. The land is warming faster than the oceans and faster at higher latitudes. People are struggling to work under hot, humid conditions. There are more frequent and severe extreme weather events. Assets are becoming stranded or uninsurable; mortgages are being defaulted on. The cost of living is escalating due to increased food shortages. This is an extreme but plausible scenario;* is it one that you have discussed in the boardroom?

Climate scenario analysis is becoming an essential forward-looking tool for financial institutions to assess their resilience to alternative future states of the world. If done well, scenario analysis can power better strategic decision-making. It can help non-executive directors (NEDs) of financial institutions drive meaningful future-focused conversations about the implications of different warming outcomes, different paths for future decarbonisation, and different directions for policy or technology.

Alongside the strategic value of conducting robust scenario analysis, financial sector NEDs need to be aware that incoming regulatory shifts are likely to require them to do so.

In its recent consultation paper, Enhancing banks’ and insurers’ approaches to managing climate-related risk (CP 10/25), the Bank of England’s Prudential Regulation Authority (PRA) identified opportunities for firms to further improve the integration of scenario analysis into their decision-making. This increased focus from the PRA on the role of scenario planning in financial firms’ risk management processes can reasonably be expected to be replicated globally as the impact of physical climate risks and transition risks manifests.

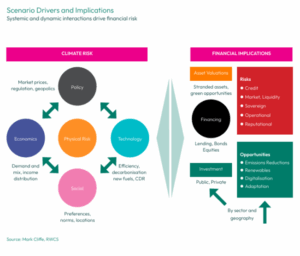

Studies have shown that current scenario analysis practices are not capturing the full extent of climate impacts for financial firms. The Climate Financial Risk Forum (CFRF) and the Network for Greening the Financial System (NGFS) highlight the importance of evolving practice in scenario analysis, combining the latest modelling with real-world narratives to ensure firms are aware of the potential implications. For example, models can forecast temperate increases that could result in floods or wildfires, or both. Narratives can ask the questions: what would resulting tech disruption or a surge in stranded assets mean for credit lines and asset managers? How might boards have to pivot strategy to rebalance portfolios and ensure firms navigate turbulent markets?

Good governance of risk and resilience is essential to protecting and enhancing value. As climate risks materialise, it is crucial for boards to understand the manifold potential future impacts.

Key board actions

- Capture strategic value: Scenario analysis needs to go beyond a compliance exercise and be viewed as a tool to enable boards to anticipate future risks, better understand the implications of different risk and value drivers, and enhance resilience. Avoid getting bogged down in the technical details, keep discussions focused on the most material issues rather than abstract or extreme scenarios.

- Monitor regulatory expectations: The PRA (SS 3/19) and IFRS Climate-related Disclosure Standards require firms to use scenario analysis for risk identification and disclosure. Recent proposals (e.g. PRA CP 10/35) are seeking to strengthen these expectations.

- Combine modelling and narrative approaches: Combining narratives with quantitative models can better capture risk impacts, including cascading risks and tipping points, and open up key strategic conversations. Consider reverse stress-testing to determine “what type of climate scenario would result in the firm no longer being able to carry out its business activities”.

- Review regularly: Understanding of climate tipping points and cascading risks is evolving. Boards need to ensure that the scenarios they are considering incorporate the latest science and thinking in these critical areas. Boards need to ensure they understand the assumptions and process behind the management’s analysis and explore the implications of modelling limitations – seeking explanations of how conclusions have been reached and exposing uncertainties and disagreements.

- Embed oversight into governance: Boards, especially NEDs, should oversee scenario analysis, challenge assumptions, and focus on material risks to unlock strategic insights and strengthen resilience. NEDs can ensure that the executive has clear objectives for their scenario analysis: what questions are they asking? How will the information be used in decision-making? Consider how scenario analysis is integrated into Audit & Risk Committee functions and how this is reviewed at full board level.

Deep Dive: tools and approaches

Regulatory and strategic drivers

The PRA’s 2019 supervisory statement (SS 3/19) set a clear expectation that firms use scenario analysis and stress testing to inform risk identification and improve their understanding of the financial risks to their business model from climate change. The proposals in the PRA’s recent consultation paper – discussed further below – strengthen that expectation. Disclosure of the outcomes of scenario analysis is also required by the Climate-related Disclosures Standard developed by the IFRS Foundation’s International Sustainability Standards Board.

As they respond to regulatory and disclosure requirements in this area, firms have an opportunity to begin to explore the use of scenario analysis as a forward-looking, strategic and risk management tool – an input to strategic decision-making in an uncertain world. It therefore directly supports boards in fulfilling their duties: helping them understand the context in which their business operates and helping them assess the implications of different risk and value drivers.

The strategic benefit of the exercise lies as much in the board’s discussion of narratives, and in the review and challenge of scenario outcomes, as it does in the modelling itself. Climate scenario analysis is a vehicle to explore a wide range of different futures – including extreme futures in which tipping points are reached and the social, economic and monetary systems that we are used to begin to unravel.

Discussing these scenarios can be unsettling. But engaging with them can be a useful device to spark much-needed strategic discussions and accelerate climate action.

After all, financial institutions are not simply risk takers. Through their interactions across the economy, and their risk and financing decisions, they also shape future risks. So, the decisions and actions that financial institutions take can have an important bearing on the likelihood that more extreme scenarios crystallise.

Enhancing scenario analysis: tools and approaches

Climate scenario analysis has emerged as a key risk assessment tool to examine future climate-related risks.

Risks associated with further global warming, and policy responses to mitigate it, have no comparable historical precedent. Given the forward-looking character of climate-related risks, including non-linearities, potential for tipping points and irreversible damage, standard stress testing and scenario analysis approaches calibrated on backward looking data are not suitable predictors of climate-related risk. CSA [climate scenario analysis] is a key tool to account for the uncertainty about future climate-related outcomes

(PRA, CP 10/25)

Practice has evolved considerably since climate scenario analysis was mainstreamed by the Taskforce on Climate-related Financial Disclosures in 2017. The field continues to evolve and the body of guidance to support firms in this activity continues to grow.

Scenario analysis approaches vary in their complexity and sophistication, and in the degree to which they rely on quantitative and model-driven inputs (see, for example, the guide developed by the MSCI Sustainability Institute).

A clear narrative is an essential feature of a well-designed scenario. Building from a clear narrative, firms can consider (i) how far to quantify those narratives, (ii) how to capture non-linearities, and (iii) how to evaluate the assumptions and limitations of modelling inputs. Boxes 1 and 2, respectively, introduce real-world narratives and quantified approaches to scenario analysis.

How NEDs can drive change in their organisations

The PRA’s proposals set a clear expectation that the board will be involved in overseeing the firm’s use of scenario analysis.

NEDs can offer powerful challenge and, by engaging effectively, unlock the power of scenario analysis as a strategic tool. Importantly, boards should ensure that the executive has clear objectives for their scenario analysis: what questions are they asking? How will the information be used in decision-making?

Board members should also be careful not to get bogged down in technical details. That said, they must probe enough to be able to understand the assumptions and process behind the management’s analysis and explore the implications of modelling limitations – seeking explanations of how conclusions were reached and exposing uncertainties and disagreements.

Boards must keep discussions focused on the most material issues rather than abstract or extreme scenarios. With the right framing, scenario analysis should open up strategic conversations on matters such as:

- Where are the ‘hotspots’?

- Which sectors may no longer be viable?

- What emerging technologies (e.g. green hydrogen) are likely to reshape industries?

- What are the potential policy and economic dependencies and what is the sensitivity to different outcomes

- How will sectoral dynamics interact across the economy?

*Scenario adapted from a Network for Greening the Financial System (NGFS) disorderly scenario. See: https://www.ngfs.net/ngfs-scenarios-portal/