NGFS Short-Term Climate Scenarios for Central Banks and Supervisors

For central banks and other financial actors, it has become increasingly important to understand the impacts of climate-related risks on economies and financial systems in the near term. To support this, NGFS has developed a set of short-term climate scenarios designed to explore how climate change and related policies could affect economies and financial systems over the next five years. They complement the NGFS’s long-term scenarios by focusing on near-term risks and outcomes that are highly relevant for central banks, supervisors, and financial institutions.

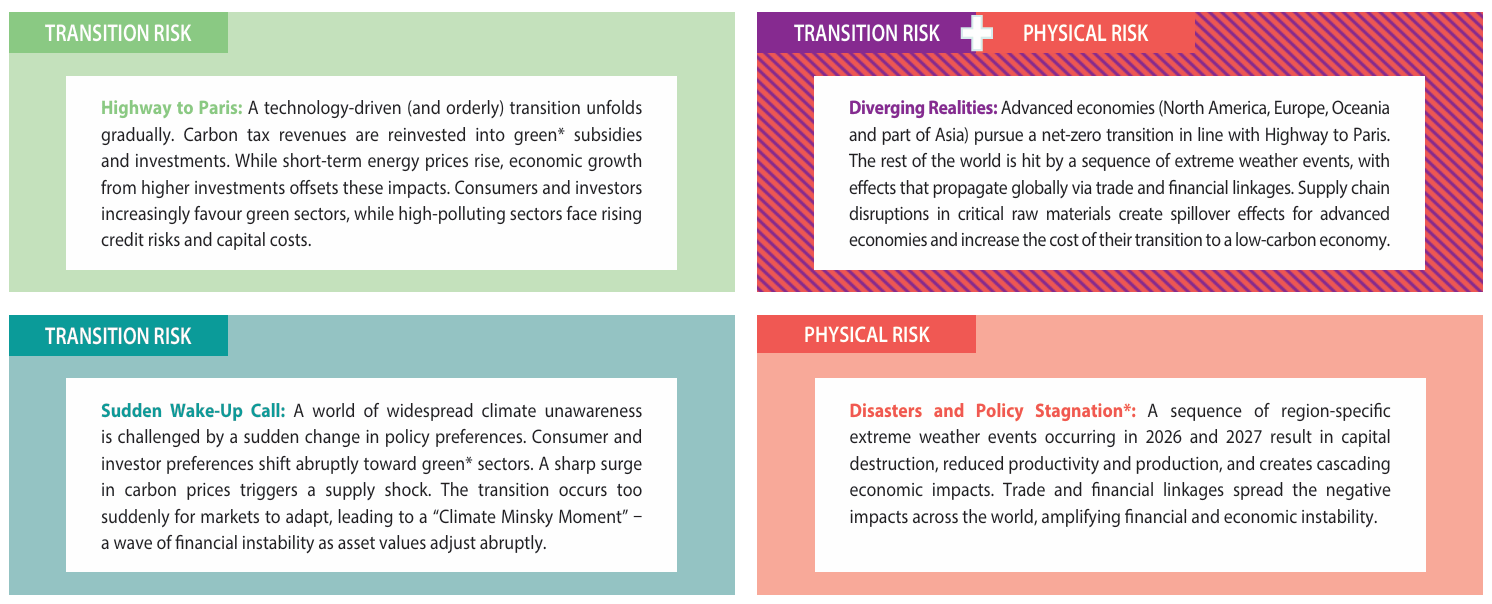

The scenarios examine how different combinations of climate policies (transition risks), physical events such as extreme weather (physical risks), and broader macro-financial developments may interact. This provides a practical tool for policymakers and the financial sector to test resilience, assess vulnerabilities, and inform decision-making in the immediate future.

The short-term scenarios are focused on a five-year time horizon and set out four alternative pathways for how climate policy and physical risks could evolve. These pathways are:

Source: NGFS