Legal considerations for transition planning: Legacy business and risks

The event introduced the series with an overview of the interaction between climate change, legal issues and business. The session then explored how these issues are affecting board decisions relating to legacy business and risk, through presentations and facilitated discussion. Directors were briefed on key trends in climate-related litigation and regulation before considering how their organisations might navigate legal elements as they transition from past approaches toward net zero.

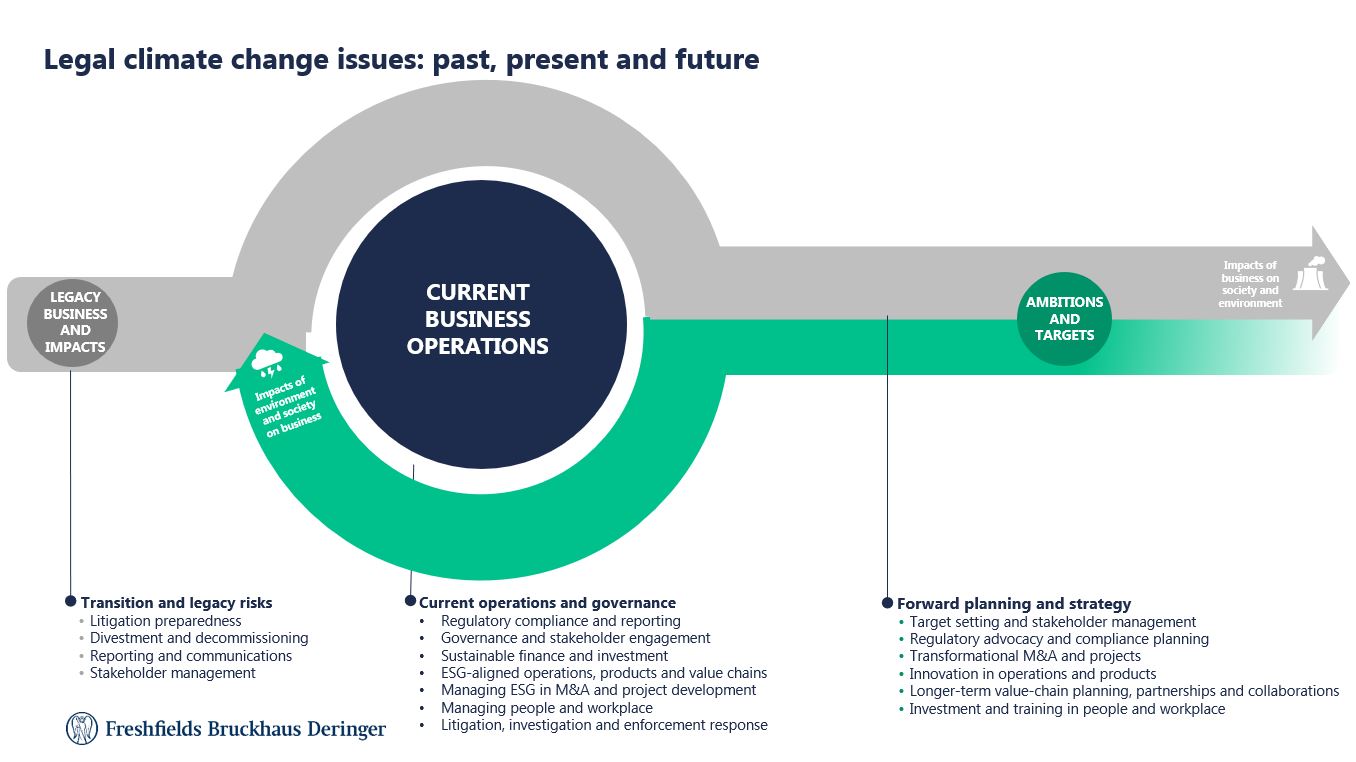

Vicky Moffatt, CEO of Chapter Zero, highlighted the growth of both Chapter Zero and similar networks around the world organised through the Climate Governance Initiative – an indicator of increased board attention on climate issues. The legal profession is no exception, with Jake Reynolds, Head of Client Sustainability at Freshfields, emphasising the firm’s own commitment to sustainability across its footprint, practice areas and global markets. In thinking about the legal dimensions of climate change, Jake explained that transition can be seen literally as the movement of a ‘legacy’ business into a new, climate-aligned future form. Managing the legal risks arising from transition is akin to keeping three sets of issues spinning at the same time: the management of legacy risks; running the business today; and planning for a zero-carbon future, all of which require different types of legal attention, as shown below.

Key takeaways

- Legal action against companies is increasingly used as a tool for change, placing pressure on organisations to align with the net zero transition. While litigation poses a range of risks to entities and decision makers that have not adopted, or do not adopt, appropriate measures, it also presents opportunities for ambitious businesses, or even for those willing to course-correct or simply understand the legal boundaries of their responsibilities.

- Monitoring fast-changing regulatory environments and understanding their application and interaction with an organisation’s strategy and operations is essential for ensuring compliance with climate requirements – which can be especially complicated in the face of concurrent pro- and anti-ESG pressures in different markets.

- Effective governance is key for ensuring that any transition plan, but especially one with ambitious climate action, is aligned with continued financial success, as well as maintaining stakeholder trust in an increasingly environmentally conscious business landscape.

- NEDs are well-placed to push their companies toward optimising the level of ambition in climate targets across their organisations and assuring implementation. In addition to reaping financial and reputational benefits from the net zero transition, this could help mitigate future exposure to regulation and litigation.

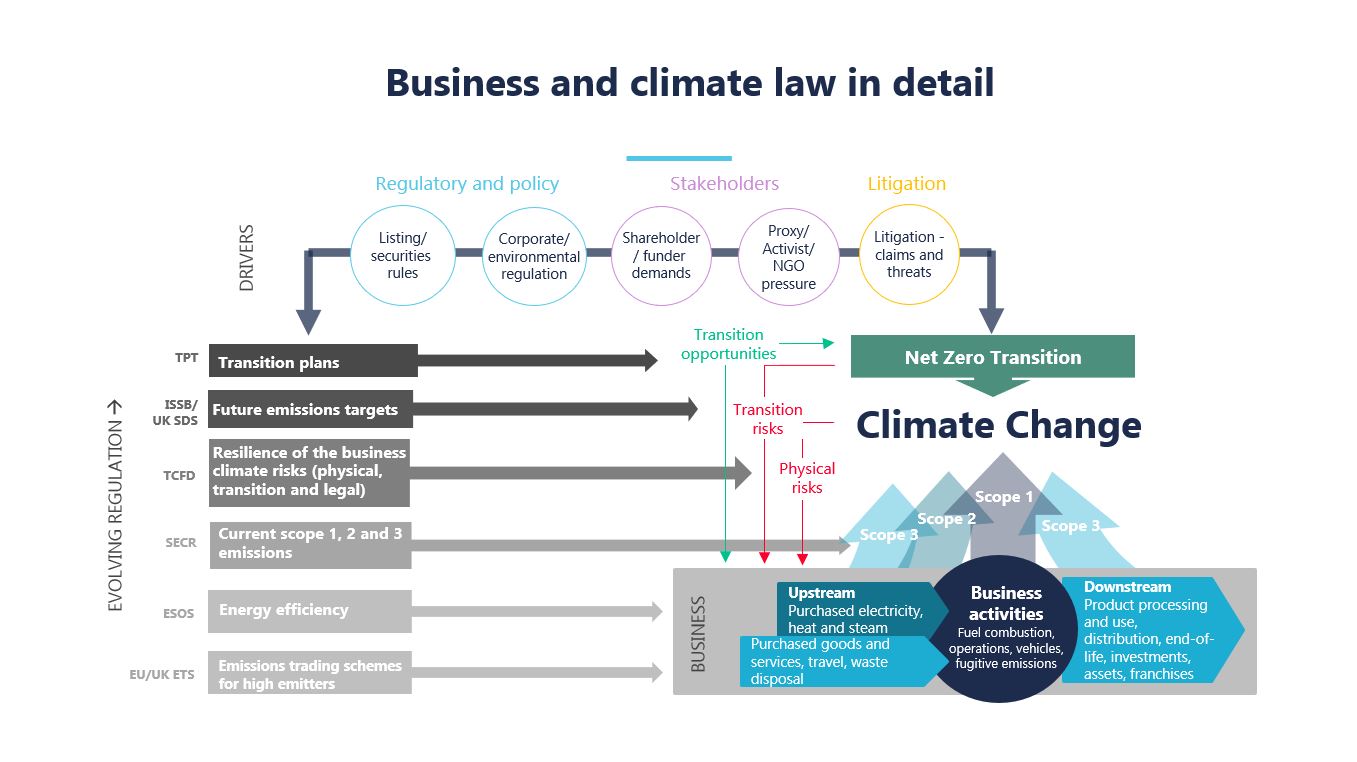

Climate regulation and litigation

Freshfields partners Vanessa Jakovich and Simon Orton offered insights into the legal risks emerging from climate change, and what they mean for boards. Regulation is central to Vanessa’s practice, and her presentation outlined the suite of topics addressed by existing and pipeline climate-related regulation applying to UK operations and UK-headquartered organisations. Early climate laws targeted the largest emitters, seeking to stimulate economy-wide emissions reductions through caps and dis-incentives on energy producers. But regulations now have a much wider effect, imposing specific obligations on businesses to measure both their contributions to climate change and their exposure to climate change risk through double materiality reporting. Going a step further, companies will soon be required by law in the UK to develop and publish credible climate transition plans. Regulators are also imposing many sector-specific obligations and standards which add to the list of climate regulations with which some businesses must comply.

Although businesses’ exposure to climate risks varies based on size and sector, there is a clear trend towards more climate regulations, with increased stringency, applying to a wider range of businesses. Directors should consider the drivers of regulation. Activists and civil society organisations have initiated many regulatory developments in the past, but businesses also have an important voice in shaping climate policy, and are indeed vocal through many progressive alliances.

Following Vanessa’s introduction, Simon Orton drew on his expertise as a dispute resolution lawyer, explaining how climate litigation is impacting business. From consumer protection to human rights, climate claims against businesses have been brought on many different grounds. Claims have also focused on different aspects of climate risk management including disclosure, strategies taken to address these risks, and representations made about corporate climate strategies.

As seen in recent litigation in the UK, directors who fail to adequately manage climate risk may also be personally exposed to litigation through derivative actions brought by minority shareholders for breach of their fiduciary duties. While the recent action against Shell’s directors failed, we can expect to see different litigation strategies emerge worldwide to hold directors accountable for the climate impacts of their businesses. While most climate litigation aims to accelerate the net zero transition, it is important to note that there is a smaller trend of ‘anti-ESG’ litigation, particularly prevalent in certain parts of the USA, creating a ‘tightrope’ for companies operating in those jurisdictions.

Despite the diversity of litigation approaches, broad principles for managing litigation risk may be similar across all UK businesses:

- Directors should ensure their business performs credible and accurate assessments of climate risks.

- Boards should require thoughtful risk mitigation plans to be drawn up based on this information.

- Businesses should follow through with commitments to address climate risks, be transparent with stakeholders about their plans, and resist the temptation to exaggerate performance claims.

Climate law in the boardroom

Having heard from the lawyers, Chapter Zero members were invited to discuss their own experiences with climate-related legal risks. Attendees represented many different businesses and sectors, so there was variation in the extent to which climate risk was a principal concern in the boardroom. Climate change is particularly important for businesses with high greenhouse gas emissions, and in sectors where regulators have imposed additional climate-related obligations. While some companies might not be as directly exposed to climate risk now, directors felt that the growth in climate regulation and litigation would make the issue a higher priority in future.

Specific challenges raised by directors include dealing with the growing scale and complexity of climate-related regulation, and avoiding litigation while making ambitious climate decisions in the face of uncertainty. Regulations such as disclosure rules have made climate change a larger part of some boards’ agendas, while other boards have been motivated by different factors such as the physical impacts of climate change or pressure for stronger climate action from clients, consumers, and investors. There was general agreement that climate-conscious directors need to find a way of localising the issue to their specific organisations and boards, whether this is driven by compliance, stakeholder pressure, or simply the significant business and commercial opportunities presented by climate transition.

The word map presented below highlights some of the main issues discussed by directors during the discussion.

This event summary was developed in collaboration with the Centre for Climate Engagement at Hughes Hall.