A year with Sustainability and ESG committees

In the boardroom: Hardwiring sustainability into strategy

"A strong Sustainability or ESG Committee ensures that climate action is not symbolic but systemic – hardwired into strategy, governance and operations."

Devyani Vaishampayan, Independent Director, Forvis Mazars; RemCo Chair and NED, NHS Supply Chain

The ESG Committee at the vanguard of change

Ultimately, climate governance is a comprehensive board issue, touching every part of business strategy, and as climate impacts become increasingly material, good governance in this area is crucial to driving a change management agenda that will ensure the business is future-fit.

The ESG Committee has been at the vanguard of this thinking, embedding climate considerations into business strategy in a myriad of ways, including:

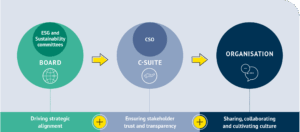

Driving strategic alignment

The ESG Committee is most effective when part of a strategic ecosystem. According to Devyani Vaishampayan (Independent Director, Forvis Mazars), by ensuring that the climate agenda does not “focus on individual initiatives and campaigns”, the committee can help align corporate strategy with long-term sustainability goals, such as net-zero targets, product design, customer satisfaction, and employee engagement.

No one person can do it all – establishing strong governance structures that work in tandem with the C-suite and are dedicated to creating the conditions necessary for change is vital. Non-executive directors can move from monitors to mentors by creating an environment that maximises the influence of a CSO, who, through passion and expertise, can drive executive ESG progress and cascade the board’s climate goals through the organisation.

Ensuring stakeholder trust and transparency

The ESG Committee plays a pivotal role in providing assurance to investors, regulators, employees, and other stakeholders that climate risks and opportunities are being properly managed.

A key area of focus for many committees has been transparency in reporting, aligned with frameworks like TCFD, ISSB, or GRI, and investing in external assurance and high-quality data technology to reduce the risk of greenwashing and reputational damage. Whilst data quality and understanding framework requirements is a “challenge for everyone”, as Tracey Kerr (Senior Independent Director, Hochschild Mining) says, forward-looking ESG Committees are seeing the value in this data beyond reporting on the here and now. Deep levels of uncertainty about the trajectory of the operating environment are making future-fit processes like transition planning mission critical.

Sharing, collaborating and cultivating culture

The change management thinking needed to realise a credible transition plan means it cannot just be the purview of one committee or business function. Claire Hawkings (Non-Executive Director, Ibstock Plc) has found that the transition planning process highlights the “importance of a network” across the board and organisation. Similarly, Tracey noted that throughout this year’s Chapter Zero Sustainability & ESG Committee dialogues the advantages and challenges of cross-committee collaboration was a recurring theme, such as what type of ESG targets should be placed in remuneration through RemCo, and that open discussion allows Chairs to lean on their peers and “tap into” their expertise.

Inevitably, challenges arise when coordinating cross-committees because, as Claire reflects, governance doesn’t “sit in a neat box.” Organisations are complex; it is important that a sustainability committee aligns to the overarching long-term strategy and interacts with renumeration or audit committees as appropriate. Different companies and boards will set up sustainability committees differently and the maturity of the committee’s agenda and priorities will vary, internally and externally. Understanding the role of each committee when addressing, for example, the audit requirements for non-financial data, climate as a business risk, or the appearance of sustainability metrics in long-term incentive plans and bonuses, require committees to define decision making and accountabilities clearly. Cultivating such pathways to effective intra- and inter-committee requires fluency across committee remits, and mutual commitment.

On continued ambition and seeding progress after the initial in-roads have been made, Devyani commented that “culture is often underestimated”. In the current scenario, “where board discussion revolves around compliance as a driving force or resilience as an inherent commitment”, the culture of the organisation can make an outsized difference.

The future of the ESG Committee

Throughout a year of listening to fellow ESG Chairs, Claire Hawkings noted that the “enthusiasm, passion, and commitment seem to still be there”. Talk of “slowdown” is not just due to geopolitical changes in jurisdictions such as the US, “it’s because it’s hard”, says Tracey. There are difficulties to get to net zero that have to be “overcome” against the current economic backdrop for cyclical sectors.

Looking to the future, topics and concerns that have cropped up across the year (transition planning, sustainability metrics and disclosures, or Scope 3) are seen as ongoing, opening up discussions about new solutions. “The aspects or angles” of the conversation may change but “none of these topics will disappear”, says Claire.

What stood out most to our Chapter Zero Fellows and event moderators was the value in the mixture of experiences in convenings. Candid discussions between Chairs, ranging from advanced to newly appointed, allowed for the airing of general concerns as well as strategies to the navigate complex issues. Tracey was particularly struck by how many attendees at the dialogues were not there to get advice “but to give”, and this air of generosity fostered open and astute conversation where everyone “benefits”.

As to what these dialogues might look like in the future? While ESG Committees ensure climate and sustainability considerations are treated as board-level priorities “not just operational side projects”, Devyani believes that the ESG committee has a necessary shelf life. Over time, and by way of accountability structures, ESG considerations need to be embedded across all business activities and board committees, reducing the need for a standalone ESG committee. Full integration relies on board committees working closely to ensure alignment on sustainability goals and embedding ESG into the broader business strategy.

Yet, there is always a risk that dissolving the ESG Committee too soon, without a robust governance structure and board commitment in place, can leave a vacuum. Companies risk making ambitious pledges without follow-through, losing stakeholder trust, and falling behind peers who have successfully established ESG at the board level.

Ultimately, our Chapter Zero Fellows reflected, ESG should be treated like health and safety – so firmly embedded in the company’s governance and operational framework, that omission from decision-making would be inconceivable.

Download PDF

A year with Sustainability & ESG Committees

Claire Hawkings

is a portfolio Non-Executive Director (NED). She is Chair of the Sustainability Committee and NED at Ibstock Plc; Chair of the Responsible Business Committee and NED at First Group Plc; Senior Independent Director with James Fisher and Sons Plc; and Non-Executive Director with Defence Equipment and Support (part of the Ministry of Defence). She also periodically works as a Business Strategy and Sustainability Adviser.

Devyani Vaishampayan

is an experienced Independent Non-Executive Director. She is RemCo Chair & NED at Norman Broadbent Plc and NHS Supply Chain along with being Independent NED at Forvis Mazars. Devyani has been a successful AI entrepreneur and has completed the successful exit of an AI Innovation Hub advising corporates on digital adoption of AI solutions around leadership, culture, and the future of work. Prior to this, Devyani was an international and multi-sector FTSE 30 Group CHRO and board member. She has occupied global roles in successful organizations across various industries such as Citibank, AT&T, British Gas, Rolls Royce, and BSI.

Tracey Kerr

is an experienced chair of safety, sustainability and technology committees. She is a Non-Executive Director at Antofagasta Plc, Hochschild Mining Plc, and at Weir Group Plc. She was previously a Non-Executive Director at Polymetal International Plc and Jubilee Metals Group Plc. She has served as Group Head of Sustainable at Anglo American, having previously been accountable for safety, operational risk management and sustainable development, and Group Head of Exploration. She is a Fellow of the Australasian Institute of Mining and Metallurgy, AUSIMM, and is a member of the Society of Economic Geologists, the Society of Exploration Geophysicists, and the Institute of Directors.