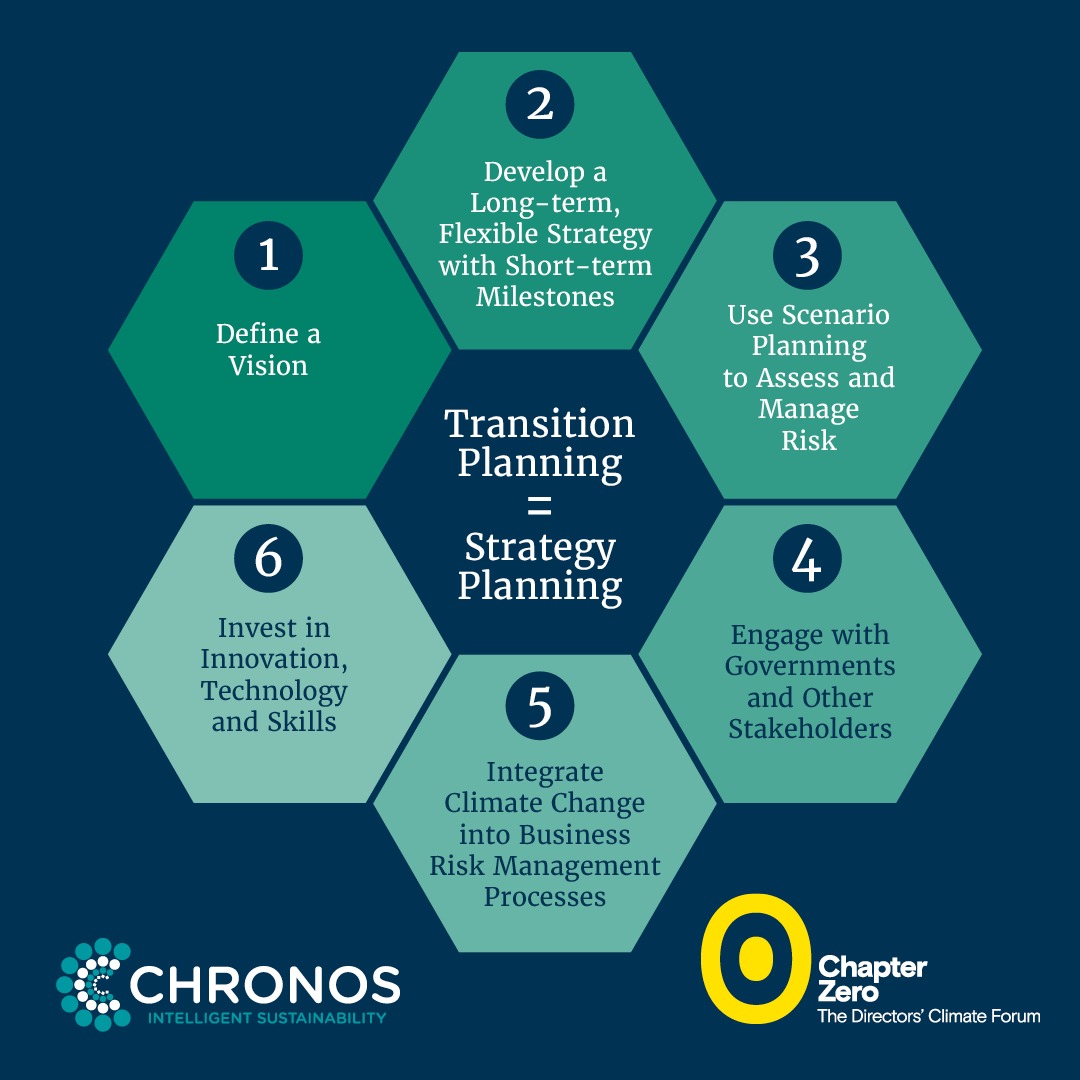

Transition Planning = Strategy Planning

Companies can reap the rewards of acting now by mitigating risks, gaining competitive advantage and ensuring their businesses are future-fit, but the decisions they make could have major financial or operational consequences. Meanwhile, the uncertainties around climate change, its impacts, and the pace of policy change create a highly complex environment for companies to take decisive action. For example, in the UK, companies need to create coherent strategies that respond to both the government’s growth agenda and corporate net zero ambitions. Given these challenges, how can companies successfully navigate the transition to net zero?

The answer lies in the boardroom. Transitioning to net zero is not simply a technical or operational challenge, it is a strategic business imperative. A carefully considered transition plan can drive long-term profitability, improve stakeholder relations, and ensure compliance with evolving regulations. However, the journey is not straightforward, and successful transition planning requires a clear understanding of the uncertainties, dependencies, and evolving external factors at play.

Below, we explore six key actions that boards can deploy to effectively manage the net zero transition in a complex and rapidly evolving landscape.

1. Define a vision

The race to net zero will influence companies in profound ways, touching everything from business models and regulatory compliance to supply chains and consumer behaviour. It means that companies face an array of opportunities, challenges, and transformations that will require strategic adaptation, innovation, and leadership. How boards navigate these changes will not only determine business competitiveness but also their companies’ roles in shaping a sustainable future. Thus, a company’s transition to net zero is best enabled when viewed as a strategy issue – one that is vision-driven, one that is ambitious, one that anticipates the future and, critically, one that is aligned with the company’s core values and business strategy. Once a vision for the company has been defined, then the transition plan can be recognised as the instrument that translates that vision into practical action.

The race to net zero will influence companies in profound ways, touching everything from business models and regulatory compliance to supply chains and consumer behaviour.

2. Develop a long-term, flexible strategy with short-term milestones

With the shift toward net zero affecting everything from business models and regulations to supply chains and consumer behaviour, boards will need to reassess their overall strategy, aligning the pursuit of financial performance with enhancing stakeholder value and building long-term resilience. Doing this well requires long-term vision and short-term adaptability.

Companies can begin by understanding the broader societal trajectory toward net zero emissions by 2050, confirming their commitment to net zero and then working backwards to identify the actions required in the immediate term. This commitment should recognise net zero as a long-term goal, but where the path to that goal evolves with shifting policies, technological developments, economic changes, and evolving societal expectations. As such, companies can move forward by setting achievable, short-term (over timeframes from one to five years) milestones that allow them to gradually progress toward their net zero goals. These milestones could include reductions in emissions, improvements in energy efficiency, increased investments in renewable energy, and the gradual integration of low-carbon technologies. These shorter-term goals (and associated actions) allow companies to maintain momentum, adapt to new information, and avoid overcommitting to strategies that might become unviable as new circumstances arise.

3. Use scenario planning to assess and manage risk

Scenario planning involves mapping out different future outcomes based on varying assumptions about policy changes, technological developments, and physical climate impacts. By considering a range of potential outcomes and their associated risks, companies can ensure that their transition strategies remain robust, regardless of how the future unfolds. Paying particular attention to policy, technology and climate and nature impact scenarios can enrich a company’s scenario analysis, ensuring that these issues are not siloed in the boardroom.

In relation to public policy, many governments are implementing, or are planning to implement, policies aimed at reducing emissions. These include carbon pricing (e.g. carbon taxes, cap-and-trade systems), renewable energy subsidies, stricter emissions regulations, and emissions trading systems. However, there are uncertainties not only around the pace at which such policies will be adopted, but also the ambition of these policies and their geographical coverage. There are also uncertainties around how changes in governments will affect climate policies. Consequently, companies need to consider the financial and business implications of a range of climate policy scenarios, from highly aggressive carbon reduction through to scenarios where there is little or no climate policy.

The pace at which low-carbon technologies, such as renewable energy, electric vehicles or carbon capture and storage, mature and become cost-competitive is another source of uncertainty. Some are already cost-competitive, while others continue to rely on significant subsidies. Companies should assess multiple scenarios regarding technology development. For example, companies might consider what happens if a major technological breakthrough accelerates decarbonisation, or conversely, if key technologies fail to scale in time.

Finally, as the real-world impacts of the climate crisis become more apparent, in addition to the transition risks which result from policy changes and potential changes in consumer behaviour, companies need to better understand the physical risks associated with climate change. These include the risks from extreme weather events like floods, heatwaves, and hurricanes to rising sea levels and biodiversity loss. Companies must assess the potential physical risks to their operations, supply chains, and assets. Stress testing against worst-case climate scenarios can help companies understand their vulnerabilities and build resilience into their strategies.

4. Engage with governments and other stakeholders

By engaging in policy advocacy and collaboration, companies can not only influence the future regulatory landscape but can also share the risks of transition with other stakeholders.

One of the most important things businesses can do to manage policy uncertainty is to advocate for clear, ambitious, joined up and predictable policy action (e.g. carbon pricing, support for clean technologies, clear emissions reduction targets that provide businesses with certainty). Companies can highlight the importance of consistent and ambitious long-term policy alignment, as this reduces the likelihood of sudden regulatory changes and allows for the most economically efficient business strategies to be adopted. Boards can work closely with their executive teams to ensure that they are not only factoring in potential policy and regulatory changes but are also considering how they can involve themselves in relevant government and industry consultations.

Companies can also benefit from collaborating with others in their industry, and beyond, to share knowledge, pool resources, and tackle common challenges. Industry collaborations can help accelerate research and development in clean technologies, while cross-sector collaborations may unblock solutions to shared problems, such as reducing emissions in supply chains or unblocking barriers to new technology deployment.

A question every NED can ask is ‘What policy assumptions did we make when developing our transition plan?’

5. Integrate climate change into business risk management processes

While the net zero transition offers a crucial opportunity for long-term business sustainability, resilience and innovation, the risks and impacts of climate change are being felt by many organisations already and will continue to be felt throughout the transition. As such, companies need to integrate climate risks into their overall enterprise risk management processes to ensure that they are prepared for both the physical impacts of climate change and the financial and reputational risks of the transition itself. Companies should ensure that climate-related risks are regularly reviewed and accounted for in their financial projections, capital expenditures, and strategic decisions. In relation to financial risks, companies should pay attention to stranded assets (assets that lose value due to climate policy or technological advancements) and access to insurance, market shifts (e.g. declining demand for fossil fuels or changing consumer preferences), access to capital (e.g. investor or lender scrutiny of transition plans), and reputational risks (e.g. ensuring that their climate ambitions and actions are being clearly and accurately communicated). This could involve making decisions such as divesting from high-carbon assets, investing in low-carbon infrastructure, or enhancing transparency and disclosure to investors.

As outlined above, companies also need to evaluate the long-term physical risks posed by shifts in climate patterns and build these into their scenario planning and risk management strategies. For example, floods and droughts can directly impact the availability of raw materials, disrupt production, impact the workforce and interfere with delivery systems. Contingency planning, diversification of suppliers, and investment in climate-resilient infrastructure are all vital components of an effective risk management strategy.

6. Invest in innovation, technology and skills

Innovation is key to harnessing the opportunities of a decarbonising world. For companies, this includes adopting clean technologies, improving energy efficiency, and driving sustainable innovation in products and services.

By embracing low-carbon technologies companies may be able to enhance their efficiency, lower operational costs and reduce their exposure to policy or regulation targeting high greenhouse gas emissions. Adopting these technologies also helps companies build their expertise and knowledge and may allow them to build the capabilities needed to access market segments. Similarly, by collaborating with startups, technology firms, universities, and research institutes and by investing in emerging technologies and partnering with innovators, companies can future proof their operations.

Alongside investing in technological innovation, companies who centralise transition planning and net zero ambitions as part of their value offer can attract new talent pools that will enable them to transition faster. Similarly, investing in skills for the transition can ensure that the current and future workforce are not only equipped to deliver the transition plan, but also feel inspired and motivated to do so.

Conclusion

The transition to net zero by 2050 marks a profound shift in how companies will operate, and acting decisively will enable businesses to stay ahead of the curve. Beyond meeting regulatory requirements, transition planning presents a strategic opportunity to unlock long-term value. A well-thought-out transition plan can drive sustained profitability, strengthen stakeholder relationships, and ensure compliance with evolving regulations. However, the path to net zero is far from straightforward, and effective planning will be dependent on companies developing a deep understanding of the uncertainties, dependencies, and dynamic external factors at play.

Successfully navigating this transition requires strategic foresight, accountability, and proactive engagement from boards. Each company faces a distinct set of challenges depending on its industry, geographic footprint, regulatory landscape, and technological readiness. By embedding sustainability into core business practices, fostering innovation, and collaborating with external stakeholders, boards are uniquely positioned to guide their companies through this complex and evolving challenge.

To explore more about how boards can guide the transition plan process for their organisations, please visit our Transition Planning Spotlight Page.

Download article PDF

Transition planning = Strategy planning

About the authors

Nicky Amos is co-founder and Managing Director of Chronos Sustainability Ltd. Nicky has extensive experience of managing corporate sustainability and directing complex multi-stakeholder processes. She advises multinational organisations and leading non-governmental organisations on the development and implementation of sustainable development strategies and measurement frameworks, materiality assessments, stakeholder dialogue and disclosure practices. At Chronos and through her previous role as Global Head of Corporate Responsibility at The Body Shop, Nicky is strategic adviser to multinational companies, working across issues from water and wastewater, wildlife, deforestation, supply chain ethics, human rights and diversity. She has led the development of established corporate benchmarks, including the Business Benchmark on Farm Animal Welfare (BBFAW) and the CCLA Corporate Mental Health Benchmark as well as industry coalitions including the Global Coalition for Animal Welfare. With Rory Sullivan, Nicky co-authored the Business of Farm Animal Welfare (Routledge, 2017).

Rory Sullivan is co-founder and CEO of Chronos Sustainability. Rory is an internationally recognised expert in sustainable finance. His particular expertise is on how the finance and the finance sector (banking insurance, investment, public finance) can support and enable the delivery of policy goals relating to climate change, nature loss and environmental protection. He has led a series of major global projects on these issues including acting as project director for the delivery of data for the first and second CA100+ Net Zero Company Benchmarks and for the Global Investor Commission on Mining 2030; developing the World Bank's Best Practice Disclosure Framework for Pension Funds; advising many asset owners and asset managers on the development and implementation of responsible investment and net zero strategies; developing, on behalf of TRAFFIC (the wildlife NGO), guidance for the Chinese banking sector on how banks might integrate action to address illegal trade in wild resources (including timber) into their risk assessment and management processes. Rory is the author/editor of eleven books and of many papers and reports on responsible investment and sustainability, including Responsible Investment in Fixed Income Markets (with Joshua Kendall,), Valuing Corporate Responsibility: How Investors Really Use Corporate Responsibility Information (Greenleaf, 2011), Putting Partnerships to Work (with Michael Warner, Greenleaf, 2004) and Business and Human Rights: Dilemmas and Solutions (Greenleaf, 2003).