Leveraging regulation (part 2): The pathway to resilience and growth

In an era of massive change and uncertainty, the role of non-executive directors (NEDs) has never been more critical. Firms are grappling with the complexities of changing policies, new markets, and evolving expectations. The sustainability reporting burden is higher than ever before. However, NEDs can move beyond compliance to leverage these frameworks for strategic advantage. Climate change and the low-carbon transition are reshaping industries at an accelerating pace, presenting both risks and opportunities. NEDs are uniquely positioned to guide their organisations through these shifts, ensuring that sustainability regulation becomes a driver of long-term value rather than a bureaucratic burden.

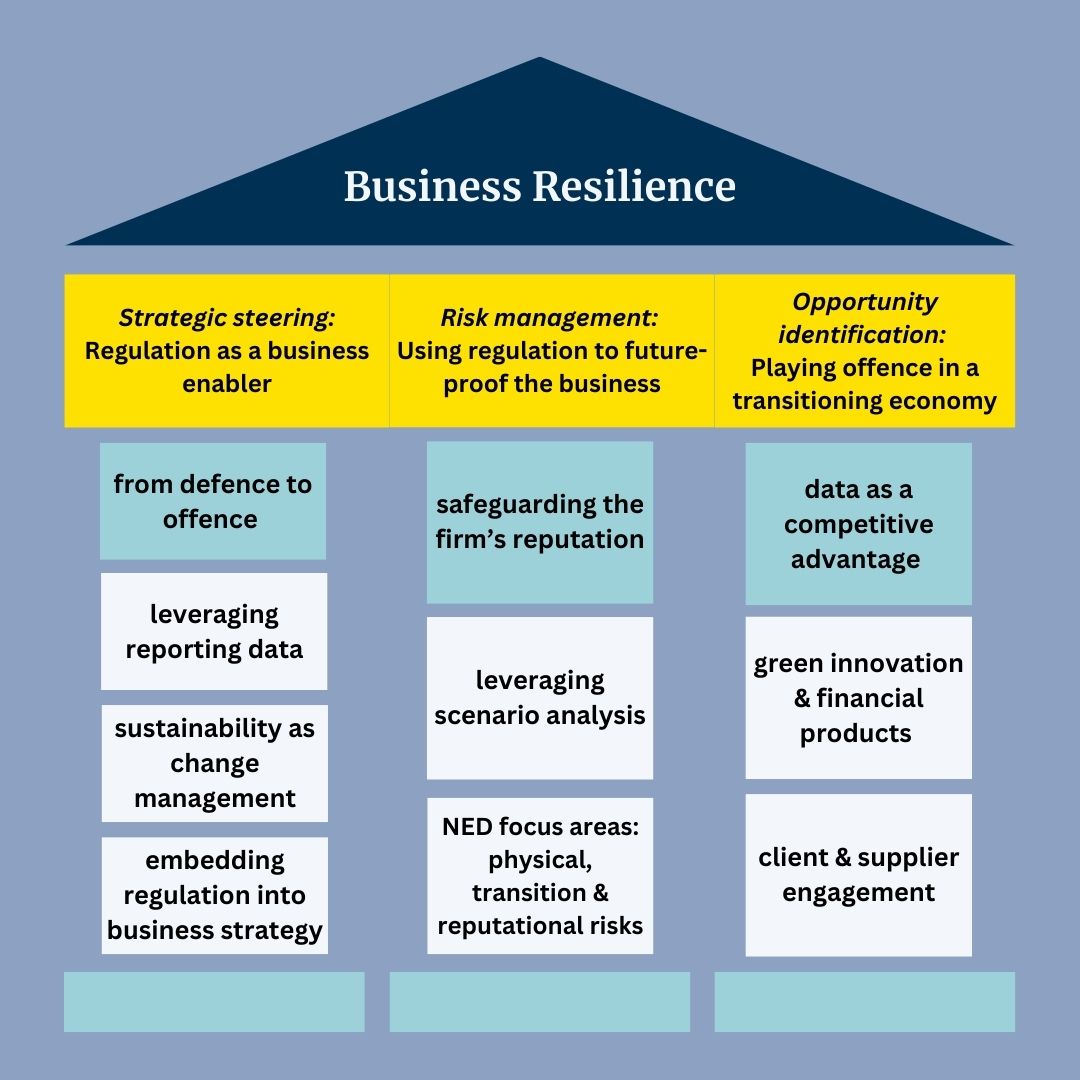

Fundamentally, NEDs exist to help firms navigate change. They have witnessed previous transformations—from globalisation to digitalisation—and now must tackle one of the most defining shifts of our time: the transition to a net-zero economy. By embedding sustainability regulation into business strategy, enhancing risk management, and identifying growth opportunities, NEDs can ensure their firms are not only resilient but also positioned for leadership.

Strategic steering: Regulation as a business enabler

For sustainability efforts to be truly effective, they must extend beyond disclosure requirements and into core business strategy. This is where NEDs can play a transformative role.

- Embedding regulation into business strategy: Sustainability should not be treated as a separate initiative but as an integral part of a company’s strategic direction. NEDs bring a breadth of experience and a long-term perspective that can help firms view regulatory shifts as catalysts for change, rather than constraints.

- Sustainability as change management: The transition is not just about new regulations; it is a fundamental change in the operating model of business akin to other global shifts. Firms that merely react to regulations will fall behind those that actively integrate sustainability into their strategic planning.

- Leveraging the data gained from reporting: Effective disclosures help firms identify financial risks and market opportunities, improve capital access, and inform strategic shifts into sustainable growth areas.

- From defence to offence: Organisations that focus only on compliance risk miss out on competitive advantages. NEDs can encourage an “offensive” approach—using regulatory-driven data to enter new markets, attract sustainable capital, and build business models that align with future policy landscapes.

Risk management: Using regulation to future-proof the business

The regulatory reporting exercise should go beyond meeting regulatory expectations and provide the motivation for thoughtful risk analysis. NEDs can help their firms proactively address climate and transition risks by encouraging the use of scenario analysis and other analytical tools.

- Leveraging scenario analysis: NEDs can encourage leadership teams to ask: What does our business look like in a net-zero world? How will rapid decarbonisation impact our operations, supply chains, and financial standing? This kind of forward-looking analysis is crucial for resilience. As an example, firms that incorporate transition risk analysis into their strategy will be better prepared for shifts in carbon pricing and policy changes.

- Key focus areas for NEDs:

- Physical climate risks: How will extreme weather events impact operations, assets, and supply chains?

- Transition risks: What are the financial and operational risks associated with shifting regulatory landscapes and evolving market expectations?

- Reputational risks: Are our sustainability claims aligned with actual impact and can we achieve the commitments we have set out?

- The role of NEDs in safeguarding the firm’s reputation: Firms that fail to substantiate their sustainability claims face increasing legal and reputational risks. NEDs should demand that sustainability strategies are backed by credible data and meaningful action, not just marketing.

Opportunity identification: Playing offence in a transitioning economy

The sustainability transition will afford firms the opportunity to position themselves for growth in the new economy. NEDs can encourage firms to view sustainability regulation as a motivator for exploring:

- Green innovation and financial products: The regulatory landscape is driving rapid innovation in sustainable finance. From green bonds to sustainability-linked loans, firms that embrace these instruments early will gain a market edge. The recommendations of the Transition Finance Market Review provide useful insight into how transition finance approaches can leverage these opportunities. Chapter Zero’s recent briefing, in partnership with the City of London, provides key takeaways for NEDs on the boards of financial institutions and firms throughout the real economy.

- Data as a competitive advantage: Sustainability reporting generates valuable insights that can inform new product offerings, supply chain efficiencies, and customer engagement strategies.

- Client and supplier engagement: Firms can use regulatory-driven sustainability disclosures to strengthen relationships with key stakeholders. Understanding and anticipating clients’ and suppliers’ sustainability needs can unlock new business opportunities and reinforce industry leadership.

Key questions for NEDs to consider

To ensure sustainability regulation is leveraged strategically, NEDs can challenge leadership teams with the following questions:

- Are our disclosures aligned with global good practices, and do they reflect our strategic priorities?

- What specific measures are in place to prevent greenwashing in our sustainability communications?

- What scenarios are we exploring and how are we using scenario analysis to identify risks and opportunities to our business?

- What steps can we take to leverage the processes of sustainability reporting for competitive advantage?

Regulation as a pathway to resilience and growth

Sustainability regulation is rapidly evolving, but firms that approach it strategically will emerge stronger, more resilient, and more competitive.

Key takeaways:

- Stay ahead of ISSB and CSRD implementation by integrating timelines into board-level discussions.

- Approach transition plans as both a risk management tool and a means of unlocking value.

- Ensure that board members have an understanding of anti-greenwashing regulations.

- Use sustainability disclosures not just for compliance but as a mechanism for market differentiation and growth.

NEDs can be catalysts in this transformation. By steering their organisations beyond compliance, they can help them harness sustainability reporting as a lever for resilience, innovation, and long-term leadership.

David Carlin is an acknowledged authority on climate change and sustainability. He is the founder of D. A. Carlin and Company, an advisor to governments, corporates, and financial institutions on climate and sustainability. He is also a Chapter Zero Fellow. He has authored numerous reports that provide practical tools and guidance to firms looking to thrive in a changing world.

David led the creation of UNEP FI’s risk programming, working with over 100 global financial institutions on topics of climate stress tests, risk modelling, TCFD and TNFD disclosure, among others. In addition, he is a contributor to Forbes, a Visiting Fellow at King’s College London, and a Senior Associate at Cambridge’s Institute for Sustainability Leadership (CISL).