UK Climate Policy Deep Dive: CCC’s Report on Climate Adaptation Progress - April 2025

Introduction: Why adaptation matters for corporate boards

by Chapter Zero Fellow Emma Howard Boyd CBE - Chair, ClientEarth; Co-Chair, Climate Resilience for All; Visiting Professor in Practice, Grantham Research Institute on Climate Change and the Environment, LSE; former Chair, London Climate Resilience Review and Environment Agency

Adaptation is the next trillion-dollar industry according to the London Stock Exchange Group in their recently published report, Investing in the green economy. The report includes key insights on adaptation from an investor perspective:

- 34% of listed companies on the FTSE All World Index already mention adaptation in their disclosures, and over 70% of real estate and utilities;

- 25% of green bonds are in areas relevant to adaptation;

- 2,100 companies, with over US$1 trillion in revenues, were identified to supply products and services that contribute to climate adaptation, accounting for roughly one-fifth of the global green economy in 2024.

These are among many of the critical reasons why engaging with the latest research on adaptation is imperative for boards so that they can provide the strategic oversight their organisations need to not only manage climate-related risks but to also ensure that they are ready to adapt successfully to a changing climate. Alongside understanding the implications of the Climate Change Committee’s (CCC) assessment of the UK’s progress on adaptation as outlined below, there are some key resources that can support board members and non-executive directors to integrate adaptation into their business strategy.

Corporate boards, particularly those of businesses operating in London or with significant ties to the city, should also read the the London Climate Resilience Review. It provides a critical assessment of how climate impacts like floods and heatwaves directly threaten urban business operations, infrastructure, and the well-being of their workforce and customer base.

The review highlights that these are not just environmental issues but fundamental business continuity and security challenges, urging boards to integrate climate adaptation into their core strategic planning to prevent significant financial losses, service disruptions, and reputational damage. It offers actionable recommendations for all stakeholders, underscoring the necessity of proactive investment and collaboration to build a resilient economy capable of withstanding escalating climate shocks.

The review’s 50 recommendations are directed to various stakeholders, including businesses, highlighting the need for a collaborative, city-wide approach to resilience. Boards can align their strategies with these broader efforts. In essence, the London Climate Resilience Review provides corporate boards with a comprehensive and localised understanding of climate risks and opportunities. By engaging with its findings, boards can ensure their companies are not only prepared for the inevitable impacts of climate change but also positioned for sustainable growth and a competitive advantage in a changing world.

Corporate boards should also read Public First’s research From risk to resilience: The case for flood-resilient communities, economy and growth, which shifts the focus from traditional, often insufficient, risk management to proactive resilience building. This research emphasises that disruption is inevitable and boards must prepare their organisations to absorb and adapt to shocks, ensuring the continuous delivery of “essential outcomes” to stakeholders. It encourages a broader view of risks, moving beyond financial concerns to encompass environmental, social, and operational threats, and highlights the interconnectedness of these challenges in complex systems like supply chains.

Furthermore, engaging with this research enables boards to enhance strategic decision-making by integrating resilience into long-term planning, employing robust scenario planning, and aligning risk appetites with impact tolerances. It also helps boards meet evolving regulatory and stakeholder expectations for operational resilience and effective governance. By understanding the insights from Public First, boards can foster a culture that anticipates and navigates disruption, ultimately bolstering their company's long-term sustainability and societal contribution.

Further recommended reading is signposted at the end of this piece.

Key takeaways for boards

- According to new Climate Change Committee (CCC) analysis, the UK is failing to make significant progress on climate adaptation, and the level and severity of climate risks is escalating as a result. The effects of continued global warming on UK weather and climate, including warmer and wetter winters, drier and hotter summers, and continued sea level rise, require a more immediate and coordinated response from across the economy. The risk of flooding is particularly acute, with CCC analysis finding that one in four properties will be at risk of flooding by 2050. Considering the timescales needed to implement adaptative technologies at scale, according to the report the UK must act quickly to prevent further infrastructure shortfalls.

- Managing adaptation risk is a business imperative. Across sectors, the evidence is overwhelmingly clear – the material impacts of climate risks pose existential threats to business. Increases in extreme weather threaten supply chains, infrastructure, and long-term business profitability. Failing to address these risks increases the potential for operational disruption, regulatory penalties, and reputational damage. The CCC’s report recognises that better accounting for climate resilience goes hand in hand with effective transition planning, as laid out in the TPT Adaptation Working Group’s work on Building Climate-ready Transition Plans. It is critical that boards view climate adaptation not just in terms of risk management, but also in terms of value creation through more productive use of capital, supply chain integrity, innovation, and long-term competitiveness.

- Underinvestment is hindering progress. The CCC upholds businesses’ responsibility in identifying investment gaps and mobilising capital towards scalable solutions to adaptation challenges. These ambitions, while echoed in the UK’s Third National Adaptation Programme (NAP3) and 2023 Green Finance Strategy (GST), remain underdeveloped in terms of the specifics of how plans and actions are delivered. The CCC pinpoints mobilising the GST’s commitment to an adaptation finance action plan as a key priority, offering businesses and industry leaders an avenue through which to feed into government strategy on how to streamline finance for climate adaptation. The report sets the objective that no viable adaptation project should fail for lack of finance, setting the stage for the private sector to step up ambition and capitalise on opportunities for delivery.

- A more efficient green transition is possible. The CCC’s progress report asserts that proactive action on investment in adaptation will help avoid locking in climate risks and infrastructure that is unfit for purpose, minimising the overall costs of tackling the climate crisis. Boards can leverage the opportunity for greater efficiency across their value chains, identifying where adaptation vulnerabilities exist and how they may be mitigated, in turn improving long-term business security. A key recommendation emerging from the report is to move beyond proxy indicators for adaptation, which will require collaboration with industry to determine how private sector data can be more effectively harnessed to monitor business risk and adaptation across critical supply chains.

- The opportunity for business leadership continues to grow. The CCC acknowledges that access to information on adaptation progress is a barrier to effective action across the economy. Boards can take forward this report’s updated picture of progress, to determine how their businesses may play an enabling role in building industry confidence in, investor support for, and greater investment in adaptation as a necessary part of the UK’s growth agenda. Boards’ capacity to model strong governance on climate adaptation as standard business practice can have an important knock-on effect on the trajectory of national progress.

Board summary

On 30 April 2025, the UK’s climate advisory group, the Climate Change Committee (CCC) published, Progress in adapting to climate change, its biennial report to Parliament on the UK’s progress in adapting to climate change, in accordance with its mandate under the Climate Change Act 2008. The report assesses the latest evidence on the implementation of the Third National Adaptation Programme (NAP3) based on a set of outcomes needed for a ‘well-adapted UK’. These outcomes look to understand climate-related risk and action priorities across sectors including the built environment and communities; land, nature and food; infrastructure; health and wellbeing; and economy. Overall, of the 46 outcomes considered, the report finds that there is not a single outcome with evidence of ‘good’ delivery on adaptation, sending a stark message that the UK’s progress on climate adaptation has been, and continues to be, inadequate.

According to the CCC, the majority of policies and plans for climate adaptation have not changed since its previous assessment in 2023. Various factors, including policy governance gaps, investment shortfalls, and the lack of consistent monitoring and evaluation systems, have contributed to this. For the private sector, the report highlights uncertainty around whether climate risk reporting - including under the current TCFD framework - is effectively translating into reduced risk exposure and increased adaptation efforts. The CCC highlights the need for more concerted public-private collaboration on clarifying the scope and level of adaptation targets, identifying technology use cases and how these should be prioritised, and determining investment routes for project delivery. This may enable more robust adaptation-related disclosure, helping both the CCC, UK government, and business sector better understand how businesses are using physical risk data in strategic decision making. Data from a Carbon Disclosure Project (CDP) 2023 survey is used to show that around only one in three UK businesses use climate change scenario analysis to inform their business strategy. The CCC’s latest progress findings suggest that a much greater percentage of UK businesses should be preparing for potentially more severe climate shocks.

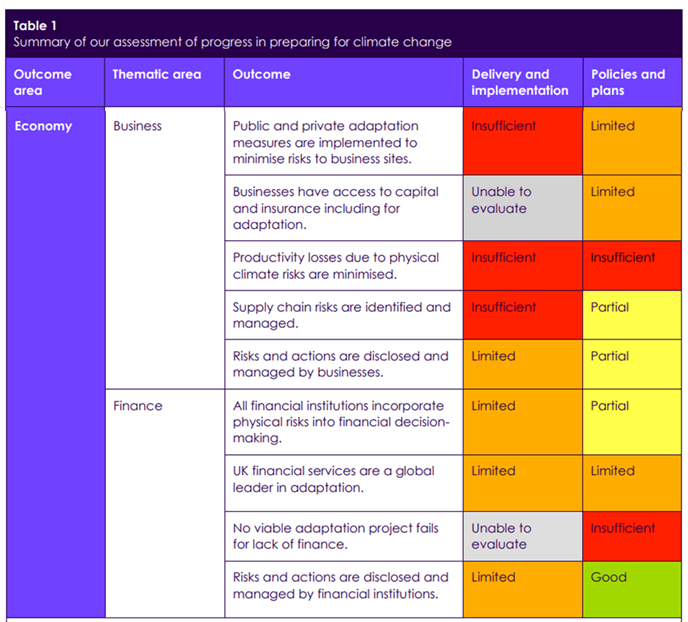

Figure 2 Assessment of climate adaptation progress in the areas of business and finance (Source: Climate Change Committee).

Without greater efforts to strengthen the resilience of the UK’s infrastructure and economy to extreme weather, the impacts of the climate crisis could destroy about 7% of the UK’s GDP by 2050, which is particularly significant considering the cost of reaching net zero emissions by 2050 is about 0.2% of GDP per year. As shown in the table below, businesses of all sizes across the economy can play a key role in committing to and delivering more proactive responses to climate adaptation risks, and it is in their interests to do so.

Board discussion areas

- How do we understand climate adaptation at the strategic level? Does our strategy and climate transition plan account for the costs associated with adapting our infrastructure to be resilient to climate shocks? How does alignment with the UK’s national adaptation goals fit into our case for investment and vision for long-term business security?

- What are the adaptation vulnerabilities at our business sites and in our value chain? Do we have the access to capital and insurance needed to act on these risks? How can we better ensure that adaptation projects make it through to delivery? Are we exploring innovative methods for financing adaptive technologies?

- Does our risk assessment and management strategy adequately account for the adaptation risks the CCC identifies or are there gaps in our understanding? Is there sufficient board-level awareness of these risks? If there are gaps in our adaptation expertise, are we engaging with the right stakeholders to address these risks?

- How do these concerns feed into our reporting obligations? What information on adaptation do we currently disclose and how could we see this changing in the future? Are we equipped to respond to increased regulatory focus on monitoring and evaluation for adaptation? Do we have a framework in place to be able to demonstrate compliance?

- Are there opportunities for business leadership that we are well-placed to seize and/or create? How can we help elevate the business imperative for more effective government prioritisation of adaptation?

- What forms of guidance and assistance from policymakers are needed to better enable businesses to deliver on climate adaptation? What priorities would we like to see enacted in the UK Green Finance Strategy’s adaptation finance action plan?

Further recommended resources

Due to the importance of adaptation measures needing to be tailored to the specific nature of local climate impacts, the below resources focus on the UK; as a board it is vital that you seek out information and resources relevant across your global footprint and value chain.

- The LSE Grantham Research Institute (GRI) has produced a range of key resources around adaptation and resilience, including explainers, policy summaries, and working papers that can equip NEDs with a clear understanding of the issues, including:

Explainer: Adaptation to climate change

Explainer: Impacts of climate change

Policy publication: Resilient net zero: exploring low-emission cooling solutions to extreme heat

Working paper: Improving the resilience of the UK labour force in a 1.5°C world

- The GRI is leading on the ATTENUATE research project in collaboration with the Environment Agency, Green Finance Institute, Love Design Studio, Paul Watkiss Associates, and the University of Bath. This work will contribute to the cross-sector investment business case for climate adaptation.

- Shade the UK provides a range of technical expertise and practical guidance on tackling the harmful impacts of overheating in the UK. Recent work includes guidance on preventing overheating in homes, an index for measuring overheating risk in buildings, and a study on enhancing heat resilience in the public realm. For businesses, this will be particularly relevant for non-executive directors in the built environment and property sectors as well as asset managers developing approaches for energy efficient, low carbon, and socially responsible adaptation of buildings and offices. For example, ensuring thermal comfort, productivity, and employee wellbeing within property portfolios, and contributing to adaptation and resilience within business localities and supply chains.

- For those on boards in the property and built environment sectors, the Better Buildings Partnership and the UK Green Building Council, particularly the UKGBC Resilience Roadmap, are key sources of information. In addition, Historic England’s ‘Whole Building Approach’ to tackling both climate mitigation and climate adaptation/resilience advocates for the need to look at both issues in parallel, and develop win-win, ‘do it once and do it right’, solutions with as many co-benefits as possible.