UK Legal Opinion: Nature-Related Risks and Directors’ Duties

In March 2024, a legal opinion authored by high-ranking corporate and financial law barristers titled ‘Nature-related risks and directors’ duties under the law of England and Wales’ was published (the Opinion). In this briefing, the Commonwealth Climate and Law Initiative outline the key findings of the Opinion, and actions directors can take to minimise the risk of breaching their legal duties.

What are the opportunities for directors?

Directors can promote the success of their company, discharge their duties, and protect themselves from legal risks using the Opinion’s five-step roadmap to address nature-related risks and steer their company competitively through the nature-positive transition.

- Identification: Directors who actively consider the extent to which their company faces nature-related risks will find it easier to make commercial decisions and justify action or inaction.

- Assessment/evaluation: Directors can assess which risks are relevant and non-trivial and evaluate their potential to cause harm to the company. This can be aided by TNFD Recommendations and associated guidance (e.g., TNFD’s LEAP framework), materiality assessments, and natural capital accounting frameworks.

- Risk management/mitigation: Consider how best to manage and/or mitigate relevant and non-trivial risks where appropriate, for example through a risk management framework. This might include incorporating nature-related risks into business strategy and ensuring directors have adequate oversight of their management.

- Disclosure: Decide: i) what needs disclosing under applicable laws, and ii) whether to voluntarily disclose (in response to market or investor expectations) material nature-related risks or impacts. The UK has one of the highest number of companies listed as committed to making disclosures aligned with the TNFD Recommendations in their corporate reporting by the financial year 2024 (or earlier) or 2025.

- Documentation: By properly recording how they have taken the above four steps (in board minutes, agendas, memoranda and reports) directors can protect themselves from legal risks.

Key takeaways

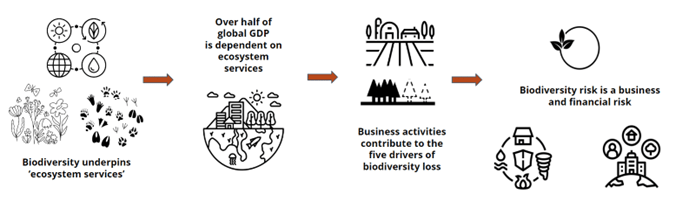

- Nature-related risks fall within existing financial risk categories and are not new. Nature-related risks are relevant to the short- and long-term success of companies.

- Board directors that do not appropriately consider such risks may face consequences for breaching their duties.

- There are opportunities for companies where their board directors proactively follow the clear, practical steps outlined above.

- Investors are increasingly interested in the relevance of nature-related risks to a company’s financial position. Nature-related risks may need to be considered in financial and non-financial reporting.

The Opinion could signal a significant shift in corporate governance towards greater consideration of environmental factors in decision-making. This could have implications for how companies operate, invest, and disclose information to stakeholders. Company directors should consider their company’s nature-related risks and act on relevant risks as part of their legal duties under the law of England and Wales, or risk breaching their duties which could lead to personal liability.

About the authors

The Commonwealth Climate and Law Initiative (CCLI) is a global non-profit legal research and stakeholder engagement initiative. The CCLI produces legal research and practical tools on how to integrate the risks and opportunities of climate change and biodiversity loss into corporate and investment governance, in order to minimise the risk of personal liability for directors, officers and investor fiduciaries, and maximise near-term efforts in the transition to a sustainable economy. The CCLI works to advance knowledge on effective sustainable governance practice. You can follow the CCLI on LinkedIn here.

In acknowledgement of the role that Pollination Group also played in the original work for this Legal Opinion:

Pollination is a global investment and advisory firm focused on climate and nature. It designs, builds and invests in climate and nature solutions to accelerate the transition to a net zero, nature positive future. Established in 2019, Pollination has brought together a global team of over 200 leading experts from across the climate and nature ecosystem; spanning finance, investment, technology, business, law, policy and science. Leveraging unique market insights, it supports clients to navigate the transition, and designs investment platforms and funds to meet investor needs and deliver real impact.