Transition Planning Toolkit: Briefing

Updated: November 2024

The Chapter Zero Transition Planning Toolkit is designed to support NEDs and their boards in overseeing the development and delivery of a credible transition plan, by anchoring climate strategy within the discussion of business strategy. The Toolkit is aligned with the Transition Plan Taskforce Disclosure Framework and Implementation Guidance

Transition Planning

Transition plans are becoming the new norm in the private sector climate journey.

We will need a fundamental transformation of business and finance if we are to successfully transition to a low greenhouse-gas emissions, climate-resilient economy. Every company will need to think carefully about what the transition means for them. They will have to think strategically about how they can protect and enhance long-term value by responding and contributing to a whole-of-economy transition.

High-quality transition plans enable management teams to develop, communicate and operationalise their climate strategies. A transition plan can focus attention, highlight key issues to be escalated to the board and instigate fundamental change in the business strategy.

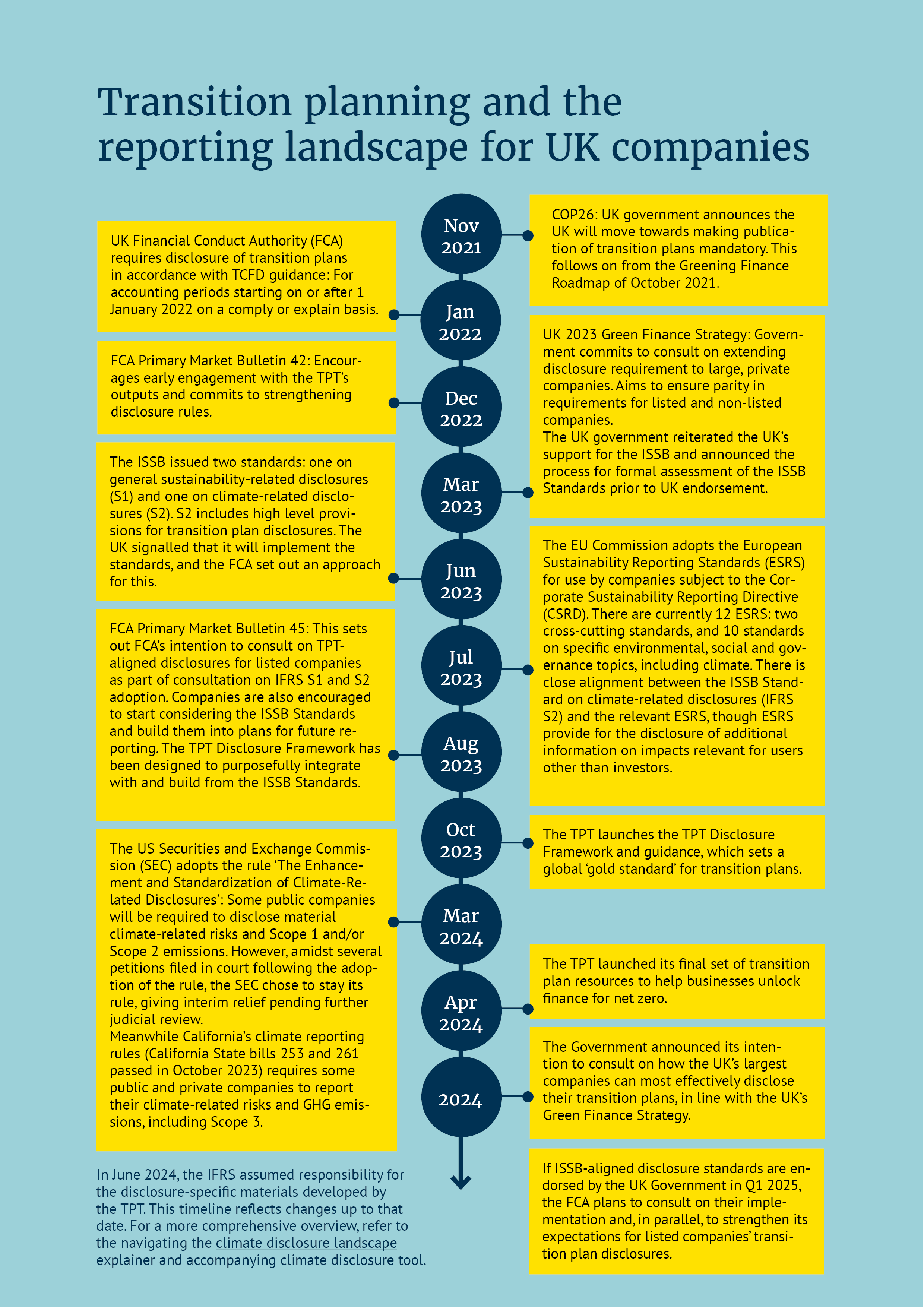

Under existing law and regulation, UK-listed companies and most other UK-registered companies and LLPs with more than 500 employees are expected to make climate-related disclosures in line with the recommendations of the global Taskforce on Climate-related Financial Disclosures (TCFD).

In the case of listed companies, the UK Financial Conduct Authority (FCA) expects disclosure of transition plans and directly references relevant TCFD guidance. The FCA has signalled its intention to strengthen these regulatory expectations.

In particular, the FCA intends to consult in Q1 2025 on amending its rules to require reporting against disclosure standards issued by the International Sustainability Standards Board (ISSB), once these have been endorsed for use in the UK. At the same time, the FCA also intends to consult on strengthening its expectations for listed companies’ transition plan disclosures, with reference to the Transition Plan Taskforce (TPT) Disclosure Framework.

Referencing the TPT Disclosure Framework in this way will be consistent with the direction of travel in the international reporting landscape. The IFRS Foundation announced in June 2024 that it will assume responsibility for the disclosure-specific materials developed by the TPT and will use these to develop educational materials.

In the meantime, the FCA has encouraged listed companies to familiarise themselves with the ISSB Standards and start to report voluntarily against them. The FCA has previously also encouraged listed companies to engage early with the TPT Disclosure Framework and consider reporting on a voluntary basis; the UK Government will also be consulting on how the UK’s largest companies can most effectively disclose their transition plans in alignment with the UK’s Green Finance Strategy.

What is a transition plan?

“A climate-related transition plan is an aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”

Source: IFRS S2 Appendix A

The Transition Plan Taskforce

The TPT, a UK government initiative with extensive industry representation was launched in April 2022 to develop the ‘gold standard’ for private sector climate transition plans. In October 2023, the TPT issued the final TPT Disclosure Framework (the ‘what’) and online Implementation Guidance (the ‘how’).

The framework was developed through a collaborative effort drawing from the wide range of expertise across the market, with over 100 organisations across finance, business, civil society, government, and academia having supported the development of the framework and over 600 organisations engaged in testing its robustness.

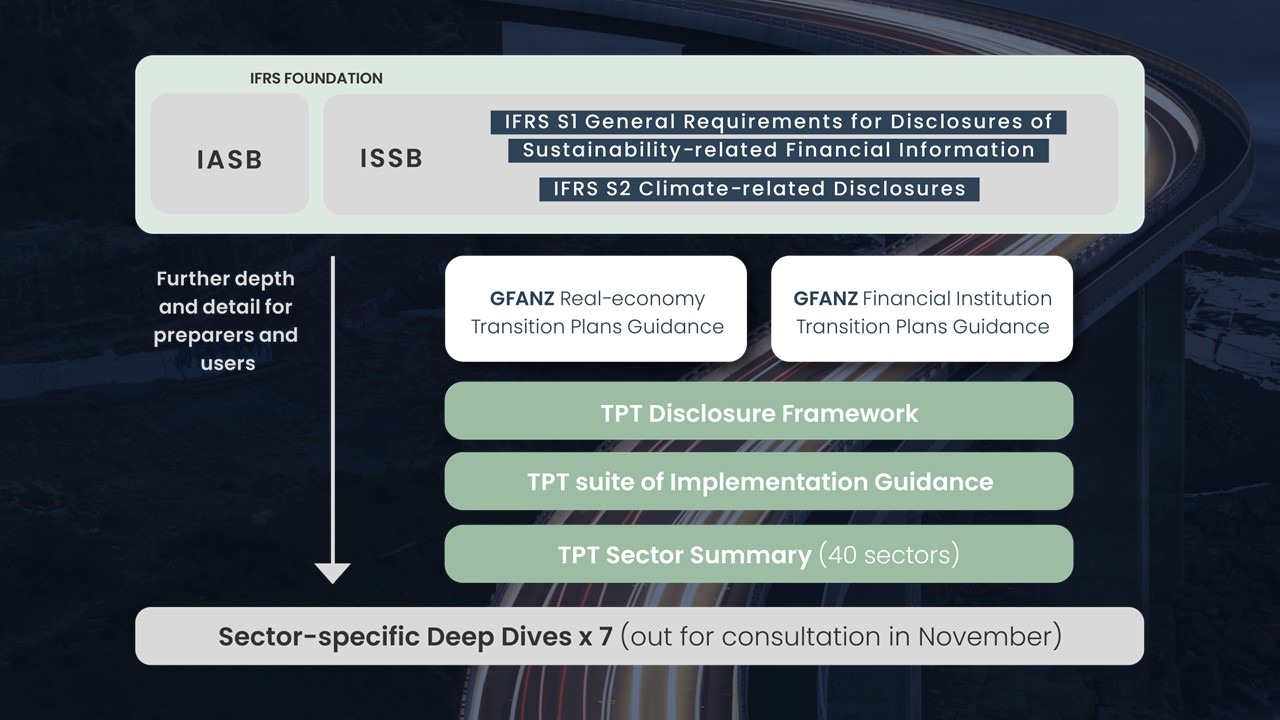

The TPT has ensured international consistency, having regard to the recommendations of the TCFD and the ISSB and aligning with, and drawing on, the Glasgow Financial Alliance for Net Zero (GFANZ) framework for credible, comprehensive and comparable net zero transition planning.

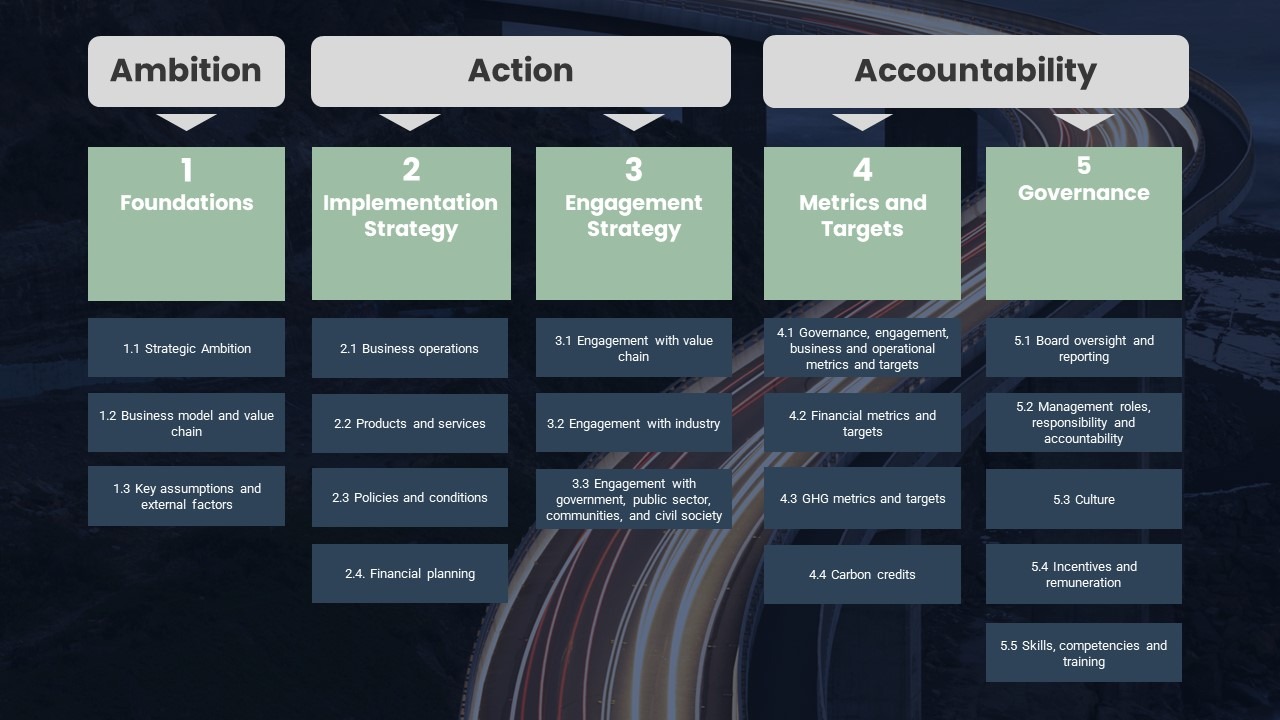

The TPT builds from the definition of a climate-related transition plan set out in the ISSB’s climate disclosure standard (IFRS S2 Appendix A), recommending that a good practice transition plan will set out an entity’s Strategic Ambition for responding and contributing to the transition towards a low GHG-emissions, climate-resilient economy.

The TPT Disclosure Framework. Source: TPT Disclosure Framework (see original diagram)

The GFANZ and TPT frameworks provide additional depth and detail to help preparers report effectively on transition-related disclosure requirements in the ISSB standards. Source: TPT Disclosure Framework (see original diagram)

Note: The TPT resources are now available via the IFRS’ Knowledge Hub. They include:

- the Disclosure Framework

- interpretative guidance on the Disclosure Framework and case studies

- guidance for companies on how to start or continue their transition planning journey (the ‘transition planning cycle’)

- technical mappings between the Disclosure Framework and the ISSB Standards and TCFD Recommendations, and a comparison between the Disclosure Framework and the European ESRS Standards

- sector summary with high-level guidance for 30 sectors across the economy

- sector-specific guidance for Asset Owners, Asset Managers, Banks, Electric Utilities & Power Generators, Food & Beverage, Metals & Mining and Oil & Gas

- a document examining legal considerations for companies preparing plans using the Disclosure Framework

- advisory papers on adaptation, nature, just transition and SMEs

- a paper on the opportunities and challenges of transition plans in emerging markets and developing economies

In June 2024, the IFRS assumed responsibility for the disclosure-specific materials developed by the TPT. This timeline reflects changes up to that date. For a more comprehensive overview, refer to the navigating the climate disclosure landscape explainer and accompanying climate disclosure tool.

|

Reporting against the Taskforce for Climate and Financial Disclosures (TCFD) framework is in force and mandatory for most large UK firms from 2022. TCFD sets a framework for climate-related financial disclosure based on four pillars: Strategy, Governance, Risk Management and Metrics & Targets.

In July 2023, the FSB asked IFRS Foundation to take over the TCFD’s responsibilities from 2024, noting that the TCFD recommendations had been absorbed into the ISSB Standards. |

|

In October 2023, the Transition Plan Taskforce (TPT) published its final disclosure framework and implementation guidance. Responsibility for the disclosure-specific materials developed by the TPT has now been assumed by IFRS, and these materials can be found on IFRS’ Knowledge Hub. It is expected that the UK FCA will consult on the inclusion of the TPT guidance when implementing the ISSB standards. |

|

In 2023, the International Financial Reporting Standards (IFRS) Foundation’s International Sustainability Standards Board (ISSB) issued two Sustainability Disclosure Standards: one on general sustainability-related disclosures and one on climate-related disclosures.

Reporting under ISSB will initially be voluntary, although ISSB’s goal is that international regulators will endorse the standards for mandatory use worldwide. In May 2024, the UK Government announced that it is aiming to endorse ISSB by Q1 2025. The International Organization of Securities Commissions has endorsed the ISSB standards and encouraged securities regulators around the world to adopt them in their legal and regulatory frameworks. |

Voluntary |

Companies have the option to use voluntary disclosure frameworks, including CDP, GRI and the recommendations on the Task Force on Nature-Related Financial Disclosures (TNFD). Disclosing to these standards and frameworks helps organisations be transparent and take responsibility for and action on impacts on climate, nature and other interlinked sustainability issues. In line with the UK Government’s May 2024 announcement, the FCA is encouraging companies to familiarise themselves with the ISSB Standards and suggesting they consider starting to report voluntarily against ISSB Standards prior to the conclusion of the UK ISSB endorsement process. |

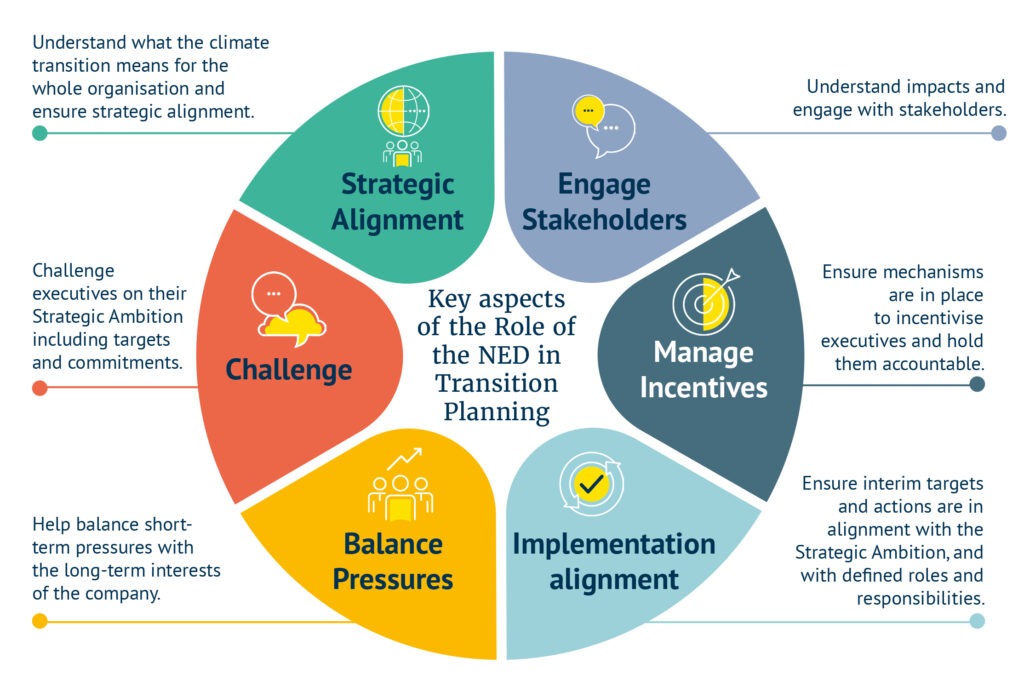

As a NED, what is your role in Transition Planning?

Transition planning will impact the core direction of travel for your company, and as a NED you need to be involved. Many of your existing responsibilities as a NED are relevant in the context of climate-related risk and opportunity, and transition planning. These include shaping the strategy and development of the business, financial planning, oversight and disclosure.

As a NED, you are particularly well positioned to mobilise the development of a transition plan given your ability to bring an independent voice and perspective to your board, and your access to a peer network which is also engaged in the process.

"Because transition planning is an exercise in fundamental business change, it falls squarely in the territory of board oversight."

Ashley Alder, Chair of the FCA

Continue to Part 2 of the Transition Planning Toolkit: Scorecard

Scorecard

Download the full Toolkit PDF

Want access to the full Transition Planning Toolkit as a PDF so you can work through it offline with your board? Click through to complete a short form and get your copy.

Download the Toolkit PDF

Chronos Sustainability

Author

Centre for Climate Engagement

Contributor

LSEG (London Stock Exchange Group)

SponsorYour feedback

We would welcome member feedback on how we can improve this Toolkit. Please share any feedback with us via the link below.

Send us your feedback