Navigating the climate disclosure landscape

There are a range of frameworks and standards supporting corporate disclosure of climate, sustainability and ESG (Environmental, Social and Governance) information. Ensuring transparent disclosure of climate risk and opportunity, so that investors and other external stakeholders are provided with relevant information to make decisions, is integral to the role of board directors.

This summary, alongside this interactive online tool, will help you understand and identify the initiatives most relevant to the company boards you sit on.

Try the interactive toolKey takeaways for UK board directors

- In the UK, there is a legal requirement for publicly listed companies, large private companies and limited liability partnerships (LLPs) to report on climate risks and opportunities. Companies may also choose to use other voluntary disclosure and reporting frameworks – see ‘Navigating the climate disclosure landscape’.

-

- As a board director, it is important to ensure the organisation you represent is meeting existing legal climate disclosure requirements, and is well prepared for increasing disclosure requirements into the future.

- Global harmonisation of sustainability disclosure standards by the International Sustainability Standards Board (ISSB) is underway, building on existing frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD) and Sustainability Accounting Standards Board (SASB) Standards. Initial ISSB Standards are expected to be issued around the end of Q2 2023.

- The UK Government has strongly backed the creation of the ISSB, whose climate standard is expected to be substantially based on the TCFD recommendations. This means that the UK’s current climate disclosure obligations are expected to be largely consistent with the international standard.

- The UK Government is planning to develop a Sustainability Disclosure Requirements framework, to bring together new and existing sustainability reporting requirements for business, the financial sector and investment products. More detail is expected in Q3 2023.

- The UK Government formed the Transition Planning Taskforce (TPT) in 2022. It is expected to launch its Disclosure Framework and Implementation Guidance for transition plans later in 2023. The UK Government will consult on the introduction of requirements for the UK’s largest companies to disclose their transition plan if they have them around Q4 2023, once the TPT has completed its work in this area.

- Delivery of a transition plan should be supported by robust governance and board oversight. As a board director, you will need the right competencies, knowledge and expertise to review and challenge the credibility of your organisation’s transition plan. Look out for Chapter Zero’s board-level guidance and support on transition planning over the coming months.

- The recently updated Green Finance Strategy outlines the Government’s policy intentions for sustainability disclosure requirements which support the UK’s commitment to becoming a net zero aligned financial centre (see Table 1). Of particular note are plans to give further consideration to the disclosure of nature related risks. This underlines a growing consensus around considering climate targets and disclosures within a broader sustainability or ESG context.

- To what extent is the board driving for, and scrutinising, broader sustainability and ESG disclosures by the organisation, including nature-related risks and opportunities?

Originally published: August 2022

Climate targets, supported by a robust delivery plan, are an important part of a business’s decarbonisation strategy. Effective climate disclosure, using appropriate reporting frameworks and standards, provides stakeholders with comparable and reliable information to make informed decisions. Climate targets and disclosures often need to be considered within a broader sustainability or ESG context. The World Economic Forum 2020 White Paper ‘Measuring Stakeholder Capitalism’ highlights that aligning with the UN Sustainable Development Goals (SDGs) will help create long-term sustainable value, while driving positive outcomes for business, the economy, society and the planet.

Global harmonisation of sustainability disclosure standards is underway. Following increasing demand from investors and corporates for comparable global sustainability data, the IFRS Foundation launched the International Sustainability Standards Board (ISSB) in November 2021. The ISSB is developing a global baseline of sustainability disclosure standards to meet investor needs, building on existing frameworks including the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations and industry-based disclosure requirements under the Sustainability Accounting Standards Board (SASB). When the ISSB standards are finalised, they will encourage companies to make a step change in sustainability reporting. Individual countries will decide whether to mandate the new standards. The UK has indicated is it likely to do so.

How can NEDs enable robust climate targets and reporting?

-

Understand the organisation’s footprint and set targets

- To set a meaningful target it is important to understand the organisation’s baseline emissions by measuring emissions across the whole value chain (scope 1, 2 and 3).

- Your company can set both near-term targets and long-term net zero targets adhering to the Science Based Target Initiative’s (SBTi’s) Net Zero Standard

- The company may want to join a coalition of climate leaders setting net-zero targets as part of the UN’s Race to Zero campaign. Accredited partners provide support and guidance on setting credible targets and delivering meaningful action.

- Consider how companies in your sector are progressing against climate goals – the World Benchmarking Alliance assesses performance in key industry sectors.

- There are a range of methodologies to support companies in setting climate targets, for further information visit ‘Navigating the climate disclosure landscape’ [link to microsite].

-

Understand the organisation’s disclosure and reporting requirements

- There is a legal requirement for most companies in the UK to report climate risks and opportunities under The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022 and the Limited Liability Partnerships (Climate-related Financial Disclosure) Regulations 2022. This information helps investors and capital providers make decisions based on the financial risk that climate change presents to a company.

- UK companies are also required to report their energy and carbon data under The Companies (Directors' Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018 which implement the government's policy on Streamlined Energy and Carbon Reporting (SECR).

- There are other voluntary disclosure and reporting frameworks that companies may decide to follow – for further information, visit ‘Navigating the climate disclosure landscape’.

-

Share your experiences

- If your company is making good progress measuring its carbon footprint, setting targets and providing credible information to stakeholders, including grappling with challenges, please contact Chapter Zero to speak to a member of the team.

Climate targets

Defining climate targets, also referred to as pledges or goals, is an important step in a company’s decarbonisation strategy. Climate targets usually take the form of a greenhouse gas (GHG) emissions reduction target from a defined baseline, to be delivered within a specific timescale. To date, companies have predominantly concentrated on establishing a baseline carbon footprint and setting carbon reduction targets, for example to achieve net zero emissions by a specific date. The focus now is on action and delivery to achieve, or refine, those targets. Developing a robust measurable climate action plan, which is an integral part of the corporate strategy and aligned with capital allocation plans, is crucial for all companies.

The scientific and international policy consensus states that net zero carbon dioxide (CO2) emissions must be reached by 2050, with 50% of emissions reductions needed by 2030, to limit global temperature increase to 1.5°C from pre-industrial levels and avoid the worst impacts of climate change, as set out in the 2015 Paris Agreement. With growing awareness and support for a net zero transition, businesses are increasingly setting their own net-zero targets.

In order to ensure credibility of corporate net-zero targets that will accelerate climate action, the World Resources Institute (WRI) proposes three key steps:

- Set near-term science-based targets, sometimes referred to as interim targets, which put a company on a net-zero trajectory without reliance on offsets. This will help companies understand how much, and how quickly, they need to reduce emissions across the full value chain (scopes 1, 2 and 3).

- Set long-term science-based net zero targets - research by the International Energy Agency (IEA) suggests that most companies can, and should, reduce their emissions by 90-95% by 2050 or sooner, with the remaining residual emissions (those not possible to eliminate) to be offset via carbon removals. See our carbon offsetting explainer for further information on offsetting and removals.

- Invest in cutting emissions beyond current activities – companies may want to consider financing additional mitigation or carbon removal activities to compensate for historical emissions or to become ‘carbon positive’.

The Science Based Targets Initiative (SBTi) provides guidance and support for companies to set science-based emissions reduction targets and has also developed a Net-Zero Standard for validating corporate net zero targets which provides clear criteria to ensure robustness.

Businesses taking ambitious climate action can sign up to the UN’s Race to Zero campaign, a coalition of credible net zero targets from business, cities, regions and investors committed to halving global emissions by 2030 and achieving net zero emissions by 2050 at latest.

At a solution-based level, RE100, EV100 and EP100 provide a platform for businesses to set and achieve ambitious commitments in relation to zero carbon electricity grids, electric vehicles and energy efficiency that will help deliver against a net-zero goal.

The Carbon Trust’s Route to Net Zero Standard also offers support for businesses on their net zero journey, and provides independent verification and certification enabling businesses to confidently report progress to stakeholders.

Mandatory reporting and disclosure

An increasing number of countries are moving towards mandatory reporting and disclosure for businesses and financial institutions.

UK

In the UK it is mandatory for the largest UK-registered businesses to disclose climate-related risks and opportunities in line with TCFD recommendations. Listed companies are expected to report in line with the TCFD’s guidance on transition plans from 2023. Companies also need to report on their energy use and carbon emissions under the government's policy on Streamlined Energy and Carbon Reporting (SECR). The UK has indicated it is likely to mandate the ISSB’s new sustainability and climate-related disclosure standards due to be issued by the end of 2022.

In April 2022, the UK Treasury launched a Transition Plan Taskforce to develop a standard for climate transition plans. The Financial Conduct Authority (FCA) will draw on the Taskforce’s outputs to strengthen their transition plan disclosure expectations of listed companies and financial institutions.

EU

In the EU, the Sustainable Finance Disclosure Regulation (SFDR) imposed mandatory ESG disclosure obligations for asset managers and other financial markets participants from March 2021, with additional entity and product level disclosures required from January 2022.

In addition, the European Financial Reporting Advisory Group (EFRAG) is supporting the European Commission in preparing draft EU Sustainability Reporting Standards.

The EU taxonomy creates an accepted classification system for sustainable economic activity supporting the EU transition towards climate-neutrality by 2050 and the European Green Deal objectives. It aims to give clarity for companies, capital markets and policymakers and acts as a screening tool supporting investment flows into sustainable economic activities.

International

The US Securities and Exchange Commission (SEC), the Canadian Securities Administrators (CSA) and Japan’s Financial Services Agency (FSA) are all preparing for similar mandatory approaches in line with the 2021 announcement from G7 finance ministers to mandate climate-related financial reporting based on TCFD recommendations.

A 2022 report by the Global Reporting Initiative (GRI) summarises climate reporting in ASEAN where a number of countries have reporting and disclosure requirements in place for publicly listed companies including Singapore, Malaysia, Thailand and Indonesia.

Voluntary standards

There are a number of voluntary frameworks and standards that an organisation can consider using for climate and sustainability reporting and disclosure. The new International Sustainability Standards Board (ISSB) is developing a global baseline of high-quality sustainability disclosure standards to meet investor needs. The ISSB’s first two proposed standards build on TCFD recommendations and incorporate industry-based disclosure requirements derived from SASB Standards. Consolidation of the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation under the IFRS is an important step towards improved connectivity between sustainability and financial reporting, helping to ensure corporate transparency that meets the needs of all stakeholders.

Tool for navigating the climate disclosure landscape

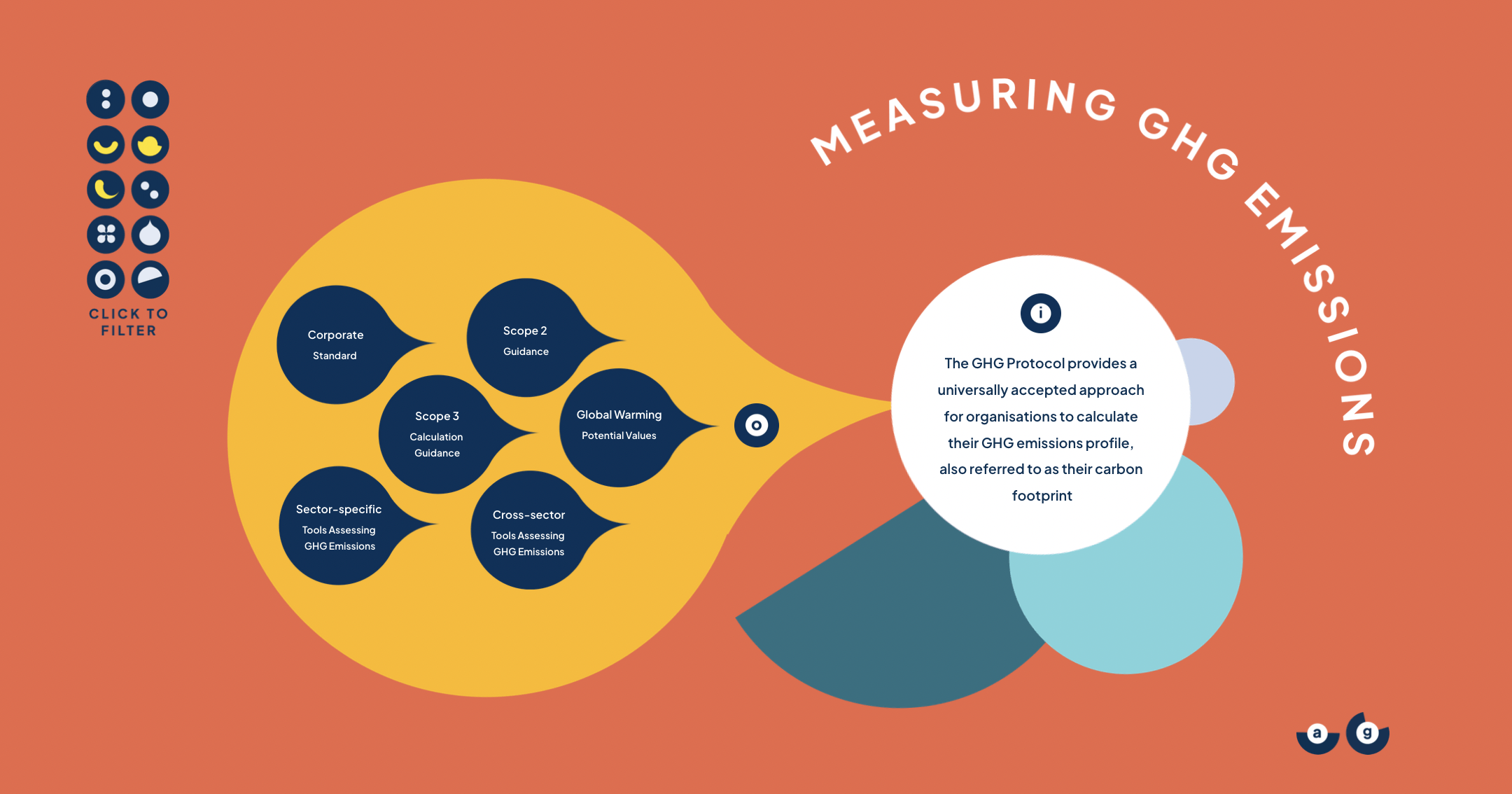

Development of the IFRS Sustainability Disclosure Standards under the ISSB will help to consolidate the labyrinth of sustainability reporting frameworks and standards that currently exist. The Centre for Climate Engagement (CCE) has developed a simple tool for ‘Navigating the climate disclosure landscape’. This tool provides basic information about what the different frameworks and standards are used for, and who they are aimed at, framed under the following categories:

- Standards for Measuring GHG Emissions provide guidance on how to account for and present data on emissions. The Greenhouse Gas (GHG) Protocol provides an internationally accepted approach for accounting and reporting on greenhouse gas emissions.

- Climate Targets are a critical step in an organisation’s decarbonisation strategy allowing businesses to define climate ambition within a specific timeframe and track progress. The Science-Based Targets Initiative, The Climate Pledge and PAS 2060 all support business to set ambitious climate targets.

- Management System Standards provide guidance for companies to create processes to manage risks and opportunities and to deliver continued performance improvements. Common standards include ISO 14001 to manage environmental issues.

- Sustainability Reporting and Disclosure Frameworks and Standards provide guidance on how a business’ sustainability information should be presented in publicly available reports. These frameworks are important to facilitate disclosure of comparable, consistent and reliable information, for example, the Global Reporting Initiative (GRI) Standards, the SASB Standards, CDP and the TCFD Recommendations.

- Investor data via sustainability indices supports institutional investors to benchmark companies on a range of ESG metrics. MSCI is the world’s largest provider of ESG indexes for investors. Stock market indices also provide benchmarks for listed companies including FTSE4Good, Dow Jones Sustainability World Index, Singapore Exchange (SGX) Sustainability Indices, and the Hang Seng Corporate Sustainability Index.

The tool can be filtered by different categories, depending which different elements of disclosure the user is interested in e.g. disclosure frameworks and standards, GHG calculation tools, science based targets, etc. Click through to the tool below to explore the climate disclosure landscape.

Useful links and further reading

- Get ready for sustainability disclosures - KPMG Global (home.kpmg) – KPMG guidance for business to prepare for sustainability disclosure requirements under the ISSB.

- FRC work on ESG and Climate reporting – Financial Reporting Council (FRC) support for companies to report on climate considerations and impact.

- Best Practices for Sustainability Reporting | NYSE ESG Guidance - New York Stock Exchange ESG Guidance: Best Practices for Sustainability Reporting

- TCFD reporting requirements and assurance considerations | Deloitte UK – Deloitte guidance for audit committees on TCFD reporting.

- TCFD_disclosure_report_2021_FINAL.pdf (cdp.net) – ‘Shaping High-quality Mandatory Disclosure’, 2021. A summary of TCFD-aligned disclosure around the world considering mandatory and voluntary frameworks.

- WEF_IBC_Measuring_Stakeholder_Capitalism_Report_2020.pdf (weforum.org), September 2020 - Towards Common Metrics and Consistent Reporting of Sustainable Value Creation, WEF White Paper in collaboration with Deloitte, EY, KPMG and PwC.

- Climate Leadership Now - We Mean Business Coalition. Accelerate your journey to climate leadership.

- A4S Navigating the Reporting Landscape - This guide introduces the changing corporate reporting landscape summarising recent developments in sustainability reporting and how this is impacting the role of the accountant and shaping the future of corporate reporting.

- A4S Net Zero Guidance - To help CFOs and finance teams to support their commitments and achieve net zero emissions, A4S has produced a series of guides, case studies and top tips.

Glossary of terms

Visit the Climate Governance Initiative (CGI)’s climate terminology page for a full glossary of climate terms for NEDs.

Table 1

UK Government upcoming timetable of disclosure-related activities (adapted from the 2023 Green Finance Strategy)

Key: Consultation opportunities, Government goals

Timing |

Activity |

| Current | Consultation on the Regulation of ESG Ratings Providers (closing June 30, 2023) |

| In 2023 | Consult on the UK Green Taxonomy (a tool to provide investors with definitions of which economic activities should be labelled as green, to support the quality of standards, labels and disclosures.) |

| Q3 2023 | Launch a formal assessment mechanism as soon as the first two IFRS Sustainability Disclosure Standards are published (expected June 2023).

Set out further detail on the Sustainability Disclosure Requirements implementation timeline to reflect the rapid development of international standards Engage stakeholders on an update to the Environmental Reporting Guidelines, which provide voluntary reporting guidance for UK organisations Launch a call for evidence on Scope 3 emissions reporting |

| Q4 2023 | Consult on the introduction of requirements for the UK’s largest companies to disclose their transition plan if they have them. This consultation will take place once the TPT has completed its work in Autumn/Winter 2023.

Explore how best the final TNFD framework (expected September 2023) should be incorporated into UK policy and legislative architecture, in line with Target 15 of the Global Biodiversity Framework. |