Transition Planning Toolkit: Governance Compass

Updated: November 2024

Governance Compass

The role of a NED in transition planning within board committees

Transition planning falls within the remit of the board. While boards cannot delegate responsibility for transition planning to any sub-committee, they often delegate specific tasks to sub-committees.

Beyond the board sub-committees identified under the UK Corporate Governance code: the nomination committee, the audit and the remuneration committee, boards may establish non-mandatory committees, such as a climate committee or sustainability committee.

Jump to each committee section using the 'In this article we cover' links on the right of the page.

The role of the Nomination Committee

The nomination committee plays an important role in ensuring senior management have the right competencies, knowledge and expertise to effectively design, develop and deliver the transition plan, and that the board is equipped to challenge whether the plan prepared by executives is robust and credible.

The nomination committee does this through leading the process of appointments, ensuring plans are in place for orderly succession to both the board and senior management positions, and overseeing the development of a diverse pipeline for succession.

Boards hold ultimate responsibility for ensuring the long-term success of the company through strategic planning. Thus, they must anticipate future changes and challenges and take early action to ensure they have the necessary resources to address them – including the expertise and capabilities within the boardroom.

It is important to ensure that your board and senior management with responsibility for the transition plan have, or have access to, the skills, competencies and knowledge required to provide effective oversight of the transition plan.

The nomination committee plays a key role in taking a proactive stance on appointments. By thinking further ahead than the immediate replacement of retiring board members, the nomination committee can more effectively align succession plans and appointments with the company’s Strategic Ambition and transition plan.

Six questions for the nomination committee

Built upon the board’s prior work integrating the transition plan with the company’s overall strategy, these questions act as a framework for structuring nomination committee meeting agendas, and for reporting back to your fellow board members at board meetings.

- Have we assessed what skillset is required for the board and its committees to challenge whether the Strategic Ambition and the transition plan prepared by executives is robust and credible?

- Do we reassess the make-up of the board as a result of the company’s Strategic Ambition and transition plan?

- How often is a skills audit undertaken and are we keeping up with the pace of change?

- Has the skills audit identified gaps in skills, knowledge or experience?

- Does the nomination committee have recommendations regarding any changes to the composition of the board?

- Do we take account of the technical skills and knowledge required by the board and committees in the context of transition planning and the evolving climate-related reporting landscape when developing succession plans and recruiting members?

Three key actions for the chair of the nomination committee

- Lead the alignment of succession plan and board and senior management appointments with the company’s Strategic Ambition and transition plan.

- Liaise with the chair of the board on the outcome of the board evaluation exercise, and/or skills audit, and the identification of gaps and areas of board development.

- Ensure the nomination committee’s reporting in the annual report including reporting aligned with the TPT Disclosure Framework provide adequate assurance to investors that the board is competent in overseeing the design, development and delivery of a credible transition plan.

Notes on disclosure

- The FCA has restated its intention to consult on aligning to UK-endorsed ISSB standards (based on the UK Government’s announcement that it aims to endorse ISSB by Q1 2025) and is encouraging listed companies to familiarise themselves with the ISSB standards and consider starting to voluntarily report against them. The FCA has also reiterated its intention to strengthen its expectations for listed companies and the UK’s largest companies to disclose transition plans in line with the UK Government’s Green Finance Strategy.

- Reporting aligned with the TPT Disclosure Framework should include how the body(s) or individual(s) determines whether appropriate skills and competencies are available or will be developed to oversee the transition plan. (TPT sub-element 5.1 – Board oversight and reporting)

References and resources:

- The UK Corporate Governance Code, July 2018

- Guidance on Board Effectiveness, July 2018

- Sustainability Disclosure Requirements: Implementation Update 2024

- FCA Primary Market Bulletin 49

- IFRS: Transition Plan Taskforce Resources

The role of the Audit and Risk Committee

The audit committee has historically dealt with tasks related to financial reporting, internal controls, risk management, compliance and audit. In the context of an evolving sustainability reporting landscape, the role of the audit and risk committee becomes ever more prominent.

How can the audit and risk committee support transition planning?

The audit and risk committee can play a key role in overseeing internal controls over sustainability-related risks and opportunities. The committee may also assist the board in carrying out its responsibilities in relation to sustainability-related disclosures.

The committee may oversee the processes and controls in place to ensure the accuracy and robustness of sustainability-related data. This helps to prepare the company to meet disclosure requirements and supports the development of a high-quality transition plan.

The board and committee should be clear on internal roles and responsibilities in connection to these required disclosures.

The approach taken for assurance may reflect the outcome of a dialogue between investors and the board such that the needs of stakeholders are understood and met.

Potential revisions to audit reform and corporate governance in the UK

In July 2024 during the King’s Speech, it was announced that the UK Government intends to strengthen audit and corporate governance by introducing a draft bill – the Audit, Reform and Corporate Governance Bill. The draft bill, which is yet to be published (as of October 2024), may comprise measures to establish a new audit, reporting and governance body.

Prior to this, in 2023, the Financial Reporting Council (FRC) proposed several changes to the UK Corporate Governance Code (the Code), including new provisions related to audit, risk and internal control. Although these changes will not now be made, the audit and risk committee nevertheless has responsibility for overseeing the integrity of narrative reporting, including on sustainability matters, and reviewing any significant reporting judgements.

Where a company commissions assurance or verification of ESG metrics and other sustainability-related disclosures, this should be reported on in the annual report. The TPT Disclosure Framework recommends that the company make certain disclosures about any assurance or verification engagement that it has sought, such as the nature of the engagement and which aspects of the transition plan have been assured or verified.

Ten questions for the audit and risk committee

These questions act as prompts for the audit and risk committee to consider in meeting agendas, and for reporting back to your fellow board members at board meetings.

The committee may consider prompts on non-financial reporting to reference TCFD-aligned reporting along with any supplementary reporting aligned with the ISSB standards and/or the TPT Disclosure Framework. The UK has confirmed its commitment to implement the ISSB standards. The output of the TPT has been designed to lock into future ISSB reporting and applies ISSB corporate reporting norms.

- Are you satisfied that the company has adequate internal controls over risk, including climate-related risk?

- Are climate-related risks understood within the broader question of what they mean for the business, how they shape the company strategy?

- Are there clear procedures and triggers in place to elevate climate-related risks to the board quickly?

- Has management undertaken a gap analysis of current TCFD-aligned disclosures and supplementary reporting aligned with the ISSB standards and the TPT Disclosure Framework and is there a plan in place to remediate any gaps?

- Is the non-financial information used in the disclosures reliable and fit for purpose?

- What assurance do we require to support the disclosures?

- How has the board assessed whether the audit and risk committee has a balance of skills and competencies necessary to fulfil its expanding remit?

- What are the trends in climate-related reporting and regulation that we need to be aware of and for which we need to prepare? Are we doing enough now to prepare for future mandatory disclosure of transition plans, and mandatory assurance?

- Are the measures to be used in performance-related remuneration science-based and independently verified, particularly in relation to the Strategic Ambition of the transition plan? (This may involve working with the remuneration committee)

- What steps have we taken to ensure that we possess the necessary skills and expertise to effectively fulfil our evolving responsibilities related to the transition plan and sustainability reporting? (This may involve working with the nomination committee.)

Five key actions for the chair of the audit and risk committee

- Align climate-related oversight activity with the board and other committees.

- Manage and communicate with stakeholders including investors, to gauge their expectations and needs concerning disclosures and assurance on climate-related disclosures.

- Emphasise continuous improvement in climate-related disclosures.

- Set clear expectations for internal and external auditors on non-financial reporting.

- Consider the right composition of members with the necessary skills.

Notes on disclosure

If ISSB-aligned disclosure standards are endorsed by the UK Government in Q1 2025, the FCA plans to consult on their implementation and to strengthen its expectations for listed companies’ transition plan disclosures.

Reporting aligned with the TPT Disclosure Framework should include:

- how the body(s) or individual(s) considers the transition plan when overseeing the entity’s strategy, major transaction decisions, risk management processes and related policies, including if any trade-offs associated with the transition plan have been considered.

- how the body(s) or individual(s) oversees target setting in the transition plan, and monitors progress towards these targets and the wider strategic ambition of the transition plan.

(TPT sub-element 5.1 – Board oversight and reporting)

Notes on external assurance

The TPT provide notes on external assurance in its online implementation guidance. Key takeaways include:

- The TPT recommendations to include material information related to the transition plan in your general purpose financial report does not change the scope of the statutory audit.

- While external assurance for climate related information is still very nascent, some entities are obtaining external assurance on sustainability-related information, including GHG emissions. Widely used assurance standards include: ISAE 3410, AA1000 Assurance Standard v3; and ISO 140543:2019.

- Sustainability-related assurance standards and ethics codes are under development. The International Auditing and Assurance Standards Board (IAASB) concluded its consultation on a Proposed International Standard on Sustainability Assurance (ISSA 5000) in December 2023, which was approved on September 20, 2024. The IAASB plans to publish the ISSA 5000 in December 2024 with guidance and application materials following in January 2025.

- The International Ethics Standards Board for Accountants (IESBA) concluded its consultation on draft International Ethics Standards for Sustainability Assurance (IESSA) and ethics standards for sustainability reporting. IESBA aims to finalise these standards by the end of 2024.

- Reporting aligned with the TPT Disclosure Framework should include if those responsible for executive oversight and delivery of the transition plan use controls and procedures to support transition planning oversight and ensure disclosed information is reliable. Entities must disclose how these controls and procedures integrate with other internal functions and state which aspects of the transition plan are subject to external assurance or verification, including the nature of the assurance or verification. (TPT sub-element 5.2 – Roles, responsibility and accountability).

References and resources:

- The UK Corporate Governance Code, July 2018

- Guidance on Board Effectiveness, July 2018

- Sustainability Disclosure Requirements: Implementation Update 2024

- FCA Primary Market Bulletin 49

- IFRS: Transition Plan Taskforce Resources

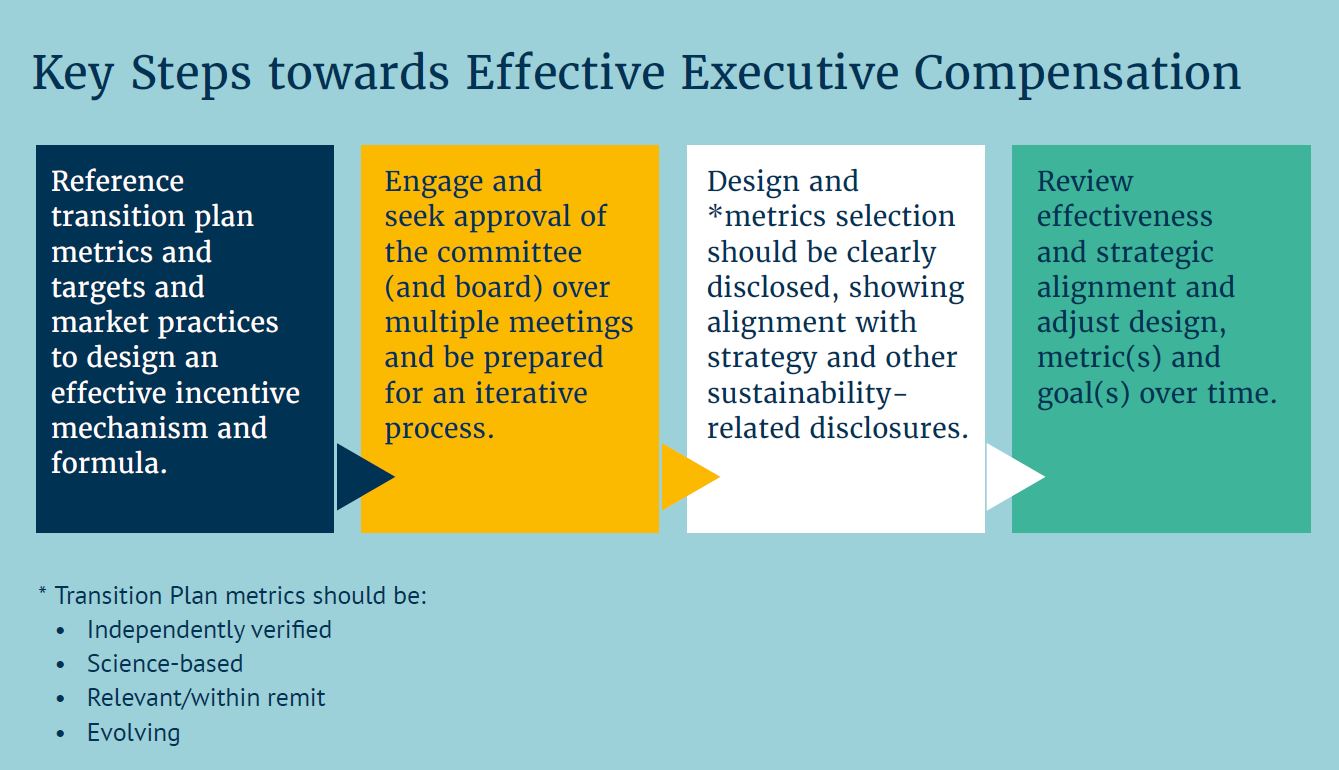

The role of the Remuneration Committee

The remuneration committee plays a pivotal role in aligning remuneration and incentive structures with the company’s Strategic Ambition and transition plan.

The company’s remuneration program needs to align with the Strategic Ambition of the transition plan to ensure that the interests of executives and other relevant staff are aligned with the successful delivery of the plan.

NEDs on the remuneration committee should ensure that performance metrics are strategically aligned, material to the individual, measurable, clear and transparent. Targets should be appropriately stretching for the relevant individual.

Relevant Guidance: WTW’s Executive Compensation Guidance for the Climate Transition (pp 15-17), and 2023 Addendum (pp 21-22)

Eight questions for remuneration committees

Built upon the board’s prior work integrating the transition plan with the company’s overall strategy, these questions act as framework for structuring remuneration committee meeting agendas, and for reporting back to your fellow board members at board meetings.

- How are we updating and aligning our executive remuneration policy to strengthen the incentives for the transition plan?

- How does executive remuneration link to our transition plan and KPIs (metrics and targets)?

- Do we need to interact with any other parts of the governance structure in respect of risks arising from remuneration?

- How will any financial and non-financial performance measures support long-term thinking and delivery against the transition plan?

- Have we considered how the choice of any particular measure may encourage negative behaviour and what steps have we taken to manage such risks?

- Have we consulted the audit and risk committee on performance measures?

- What steps have we taken to make sure that any performance measures are stretching and aligned with the ambition of the transition plan?

- Are the performance measures independently verified, science-based, relevant/within remit?

Five key actions for the chair of the remuneration committee

- Lead the alignment of remuneration with the delivery of the company’s Strategic Ambition and transition plan, and long-term strategic objectives.

- Engage with stakeholders, including investors and shareholders, to understand their expectations regarding climate-related goals and executive compensation.

- Monitor the effectiveness of the incentive structure in driving progress toward the Strategic Ambition and transition plan's objectives and be prepared to adjust remuneration structures if they are not effectively driving the desired outcomes.

- Advocate for clear and transparent disclosure of how remuneration aligns with the Strategic Ambition of the transition plan climate-related goals, both internally and in public disclosures, in accordance with reporting frameworks.

- Work closely with the chairs of the other committees to oversee benchmarking exercises to ensure that executive compensation remains competitive within the industry while and supports still reflecting the Strategic Ambition of the company’s transition plan.

Notes on disclosure

If ISSB-aligned disclosure standards are endorsed by the UK Government in Q1 2025, the FCA plans to consult on their implementation and is encouraging listed companies to familiarise themselves with the ISSB standards and consider voluntarily reporting against them. The FCA also reaffirmed its plans to strengthen its expectations for listed companies’ transition plan disclosures.

The TPT provides an example of how a construction materials company discloses information relevant to governance processes including on remuneration in Explore the Disclosure Recommendations.

Reporting aligned with the TPT Disclosure Framework should describe:

- how the entity aligns, or plans to align, its incentive and remuneration structures with the Strategic Ambition of its transition plan, and may include information about: the metric(s) used, whether the metric(s) is within the short-term and/or long-term incentive plan(s), the typical percentage weighting of the transition plan-related metric(s) within the incentive plan for the executive population and the percentage of total executive remuneration that is linked to transition planrelated metric(s).

- whether and how incentive and remuneration structures for employees across the organisation are aligned with the Strategic Ambition of its transition plan, including whether it has applied a consistent approach or whether it has taken a differentiated approach for specific teams or roles.

(TPT sub-element 5.4 – Incentives and remuneration)

The TPT provides an example of how a construction materials company discloses information relevant to governance processes, including on remuneration in Explore the Disclosure Recommendations.

References and resources:

- The UK Corporate Governance Code, July 2018

- Guidance on Board Effectiveness, July 2018

- Chapter Zero - Climate action and remuneration: A pocket guide for remuneration committees

- DP 23: Finance for Positive Sustainable Change, February 2023

- Sustainability Disclosure Requirements: Implementation Update 2024

- FCA Primary Market Bulletin 49

- IFRS: Transition Plan Taskforce Resources

The role of the Sustainability Committee

Often delegated tasks relating to achieving the company’s climate ambition and targets, the sustainability committee can play a pivotal role in crafting the company’s Strategic Ambition and a credible transition plan, and oversight on the delivery of the plan.

Boards hold ultimate responsibility for ensuring the long- term success of the company through strategic planning. In some organisations there is no longer a requirement for a sustainability committee, however, in many organisations this committee still plays an important role. Chapter Zero has found that the chair of the sustainability committee often plays a crucial role in the development of a credible transition plan for the company.

The sustainability committee can support the board in taking a strategic approach to the initiation or continued development of the company’s Strategic Ambition and transition plan such that it is integrated with the company’s strategy. Bringing recommendations to the board based on well-grounded committee research and insights can support this.

Five questions for the sustainability committee

These questions act as prompts to consider in sustainability committee meetings.

- Is the role of the committee in relation to the company’s Strategic Ambition and transition plan clearly defined in the Terms of Reference?

- Do we have the skills and knowledge to fulfil the role of the committee in relation to the Strategic Ambition and transition plan?

- Is the board connected with the work of the committee on the company’s Strategic Ambition and transition planning?

- How are we engaging stakeholders including employees and investors among others in the development of the Strategic Ambition and transition plan?

- How is the committee supporting the board in oversight activities which have not been delegated to the committee? E.g., providing useful information for strategic decision-making related to the company’s Strategic Ambition and transition plan.

Three key actions for the chair of the sustainability committee

- Ensure appropriate attention from the whole board is given to the oversight of the development and delivery of the company’s transition plan to achieve the Strategic Ambition.

- Actively engage with chairs of remuneration, nomination and audit and risk committees to ensure understanding and alignment on the Strategic Ambition and transition plan.

- Influence key decision makers to support and inform the company’s Strategic Ambition and transition plan.

Notes on disclosure

The FCA has restated its intention to consult on aligning to UK-endorsed ISSB standards (based on the UK Government’s announcement that it aims to endorse ISSB by Q1 2025) and is encouraging listed companies to familiarise themselves with the ISSB standards and consider starting to voluntarily report against them. The FCA has also reiterated its intention to strengthen its expectations for listed companies and the UK’s largest companies to disclose transition plans in line with the UK Government’s Green Finance Strategy.

Reporting aligned with the TPT disclosure framework should include information about:

- the governance body(s) (which can include a board, committee or equivalent body charged with governance) or individual(s) responsible for oversight of the transition plan.

- management’s role in the governance processes, controls and procedures used to monitor, manage and oversee the transition plan, as well as how it is embedded within the entity’s wider control, review and accountability mechanisms.

(TPT sub-element 5.1 Board oversight and reporting, 5.2 Roles, responsibility and accountability)

References and resources:

Continue to Part 4 of the Transition Planning Toolkit: Barriers and Enablers

Barriers and Enablers

Download the full Toolkit PDF

Want access to the full Transition Planning Toolkit as a PDF so you can work through it offline with your board? Click through to complete a short form and get your copy.

Download the Toolkit PDF

Chronos Sustainability

Author

Centre for Climate Engagement

Contributor

LSEG (London Stock Exchange Group)

SponsorYour feedback

We would welcome member feedback on how we can improve this Toolkit. Please share any feedback with us via the link below.

Send us your feedback