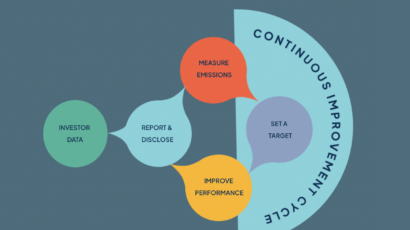

Monitoring and reporting

- effectively monitor and report climate-related disclosures

- understand the importance of data transparency and accurate reporting, along with scope 3 emissions and supply chain considerations

- and keep up with the ever-evolving landscape of climate reporting.

Featured content

Navigating the climate disclosure landscape

This explainer provides an overview of the evolving and interconnected landscape of climate targets, metrics, reporting standards and frameworks for non-executive directors (NEDs).

What is the role of open data in financing a 1.5-degree world?

During London Climate Week 2022, Climate Arc and Icebreaker One brought together 65 experts to explore how open data could be used to mainstream climate science into investment decisions.

Ecoact 2022 Corporate Climate Reporting Performance

Download the Ecoact 2022 report for: The Top 20 best performers across international research An overview of international corporate responses to net-zero The latest trends in corporate climate reporting FTSE 100 mini-report

Blog articles

View all

Five tips for your annual reports

With extensive expertise chairing multiple FTSE350 boards, as an investor and pension fund trustee, Chapter Zero Supporting Chair Sarah Bates shares her top five tips for this annual reporting season.

CFD vs TCFD – spot the difference

This Deloitte blog looks specifically at the interaction between CFD and TCFD requirements, what it means for companies caught by both, and what changes CFD implies for TCFD.

TCFD 2022 Global Progress Report for Banks

An Accenture blog on the 2022 TCFD progress report for banks.

Explainers

View all

Audit Committee Dialogue Summary: Transition planning and the changing sustainability reporting landscape

Chapter Zero recently organised a series of two roundtables for Audit Committee Chairs and members in partnership with Accounting for Sustainability (A4S) to explore forward planning, effective communication, and an understanding of emerging requirements for Audit Committees to drive climate action on boards. With expert input from A4S, the second session focused on transition planning and the changing sustainability reporting landscape. These are two topics that are critical for Audit Committees to keep ahead of, and you can find the key takeaways from the second session below.

The TNFD: a briefing to address nature in the boardroom

In September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) published its final Recommendations for businesses and financial institutions to disclose material interactions with nature. This briefing, produced by the Climate Governance Initiative, explains what these recommendations mean for you as a board director and key questions to ask in the boardroom.

Audit Committee Dialogue Summary: External reporting, internal audit, assurance and controls

In 2023, Chapter Zero organised a series of two roundtables for Audit Committee Chairs and members in partnership with Accounting for Sustainability (A4S) to explore forward planning, effective communication, and an understanding of emerging requirements for Audit Committees to drive climate action on boards. With expert input from A4S, the first session focused on external reporting requirements and internal audit and assurance controls. These are two key topics that continue to evolve and are critical for Audit Committees to keep ahead of, and you can find the key session takeaways below.

Reports

View all

Analysis of 2022 UK Company Annual Reports

A UKEB analysis of 2022 UK Company Annual Reports: A Study in Connectivity.

Achieving a circular economy: using data-sharing tools, like the Digital Product Passport

The world’s material circularity currently stands at 7.2% - having decreased from the 8.6% material circularity recorded for 2020 and the 9.1% for 2018. This WBCSD research provides a practical example of the data flows that may exist and be utilized to enable a circular economy across four sectors.

Understanding climate-related disclosures of UK financial institutions

This working paper sets out research in progress by Bank of England staff. They explore the determinants of firm disclosures by creating a unique, firm-level panel data set on climate-related disclosures of UK financial institutions.

Videos

View all

Watch: Taskforce on Nature-related Financial Disclosures

Watch Deloitte's discussion into the TNFD disclosure recommendations, including how they may be used to inform future standard setting and regulations, alongside considering the actions companies can take now to integrate nature and biodiversity into decision-making and reporting.

Watch: A focus on climate related reporting

Year-end climate related reporting for listed companies: Do you know the essential questions to ask your management team? This EY UK video explores the topic.

Watch: Climate and ESG reporting: An update for the board

In collaboration with Deloitte, we discussed the current climate and ESG reporting requirements with observations on reporting best practice. Some of the key issues for boards to consider over the coming months and to factor into your year-end accounts’ disclosures were also shared.

Events

View all

Taskforce on Nature-related Financial Disclosures

In this webinar, we will be joined by Emily McKenzie, Technical Director at TNFD Secretariat, and Sue Lloyd, Vice-Chair of the International Sustainability Standards Board, to discuss the Taskforce on Nature-related Financial Disclosures' (TNFD) recommendations, including how they may be used to inform future standard setting and regulations. We will also consider the actions companies can take now to integrate nature and biodiversity into decision-making and reporting.

Climate Dialogue: Audit Committees

Join us for a session exclusively for Audit Committee Chairs and Members, in collaboration with Accounting for Sustainability (A4S) to explore transition planning and get an understanding of emerging requirements and changing regulations for Audit Committees to drive climate action on boards.

Sustainability and climate reporting: A focus on your year-end reports

In this webinar, in collaboration with the Deloitte Academy, we will discuss the latest developments and best practice in relation to UK and Global reporting standards for sustainability and climate and when they will be applicable to UK organisations.