Embedding climate risk into decision-making

- explore strategies for assessing a company’s exposure to climate risk

- integrate these risks into strategic planning and decision making

- and use scenario planning, foresight and innovative business models to address climate challenges and uncover opportunities for growth.

Featured content

Setting the Scene on Climate Scenarios

Scenario models have formed a substantive part of managing financial risk for years. WTW look at how climate impacts – and transition - bring new subtleties to the way organizations and governments understand and use them.

Embedding climate actions in day-to-day operations

With a long-standing interest in climate and technology, after a career as company advisor and auditor, William Touche, previous leader of Deloitte’s Boardroom Program and long-time supporter of Chapter Zero, shares his reflections on business operations through a climate lens.

Bank of England report on climate-related risks and the regulatory capital frameworks

This report sets out the Bank's latest thinking on climate-related risks and regulatory capital frameworks. The report includes updates on: capability and regime gaps; capitalisation timelines; and areas for future research and analysis.

Climate risk and the financial sector

How can board directors better oversee their companies’ climate transition strategies? Our video series, in collaboration with HSBC, is designed for NEDs of banks and reinsurance companies.

Watch: Climate change: Risk management and scenario analysis

In collaboration with HSBC, this event was designed to help non-executive directors of financial institutions understand how to approach climate risk in the board debate and ensure that their institutions develop an appropriate climate risk governance and framework.

Blog articles

View all

Keeping Pace with Climate Risk and Opportunity: A Brunswick blog

Brunswick convened high-level discussions during New York Climate Week on the financial industries’ role in the climate transition. This blog captures reflections from those in attendance, and industry views on the most material developments announced throughout the week as focus intensifies on the role of finance in the climate transition.

Climate litigation – a growing risk for directors

This blog from the Institute of Directors explores climate risk and in particular examines the recent case brought against oil major Shell and what this could mean for directors.

Explainers

View all

The use of scenario analysis in disclosure of climate-related risks and opportunities

TCFD guidance on scenario analysis.

Setting the Scene on Climate Scenarios

Scenario models have formed a substantive part of managing financial risk for years. WTW look at how climate impacts – and transition - bring new subtleties to the way organizations and governments understand and use them.

Climate scenario analysis for banks and financial institutions

In this three-part series on climate scenario analysis, KPMG examines banks and other financial institutions’ end-to-end climate risk scenario analysis models.

Reports

View all

Climate Risk Leadership: Lessons from 4 Annual Surveys

While climate risk management at all financial institutions has significantly progressed in recent years, differences remain between leading firms and those that are less advanced. In this new report, GARP Risk Institute examines key trends from the previous four annual Global Climate Risk Surveys to offer a holistic view of the evolution of climate risk practices

Bank of England report on climate-related risks and the regulatory capital frameworks

This report sets out the Bank's latest thinking on climate-related risks and regulatory capital frameworks. The report includes updates on: capability and regime gaps; capitalisation timelines; and areas for future research and analysis.

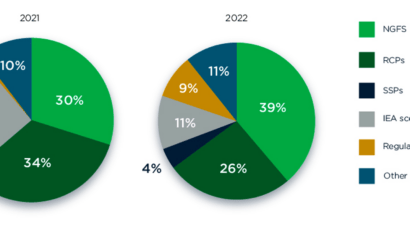

Climate scenario analysis in financial firms

GARP’s Fourth Climate Risk Management Survey was undertaken in Q2 2022. The survey comprised 62 firms, which collectively had around USD43 trillion of assets on their balance sheets, managed assets of close to USD46 trillion, and accounted for about USD3.2 trillion in market capitalization. Just over 80% of these firms have undertaken climate scenario analysis. Read the report here.

Toolkits

View all

The impact of climate change on solicitors

This guidance from The Law Society can be used to pre-empt the climate change risk your organisation faces and do business competently and compliantly.

Law & Climate Atlas

Lawyers will play a vital role in the net zero transition. Developed by the Centre for Climate Engagement in partnership with the Net Zero Lawyers Alliance, the Law & Climate Atlas provides overviews of how climate change is shaping different areas of law, and how these areas might help drive climate action.

Videos

View all

Watch: Chair's guide to valuing nature panel

Watch Deloitte’s Chair's Guide to Valuing Nature Panel from Deloitte's WEF Davos 2023 livestream series. Throughout the series, they feature leaders from around the globe as they explore Cooperation in a Fragmented World.

Watch: Climate change: Risk management and scenario analysis

In collaboration with HSBC, this event was designed to help non-executive directors of financial institutions understand how to approach climate risk in the board debate and ensure that their institutions develop an appropriate climate risk governance and framework.

Watch: Climate risk scenario

Climate change is a risk multiplier, generating increasingly unprecedented impacts on assets, supply chains, infrastructure and regulations across jurisdictions. This interactive scenario explored managing a disorderly transition.

Events

View all

[POSTPONED] Legal issues in operations and supply

THIS EVENT HAS BEEN POSTPONED AND WILL BE COMBINED WITH THE 13 FEBRUARY SESSION. Session 2 in our three-step series with Freshfields: Legal considerations for transition planning. In this event we will explore the landscape of legal factors that organisations face in their climate strategy. From short-term climate performance to adaptation, disclosure requirements to supply chain relationships, capital raising to transactions, the landscape can be overwhelming.