14 Jun 2023

Legal risks of climate inaction

Chapter Zero and White & Case held a session for non-executive directors (NEDs) in May 2023 offering practical advice and insights on the key legal duties and obligations of NEDs in relation to climate change. Here are the key takeaways.

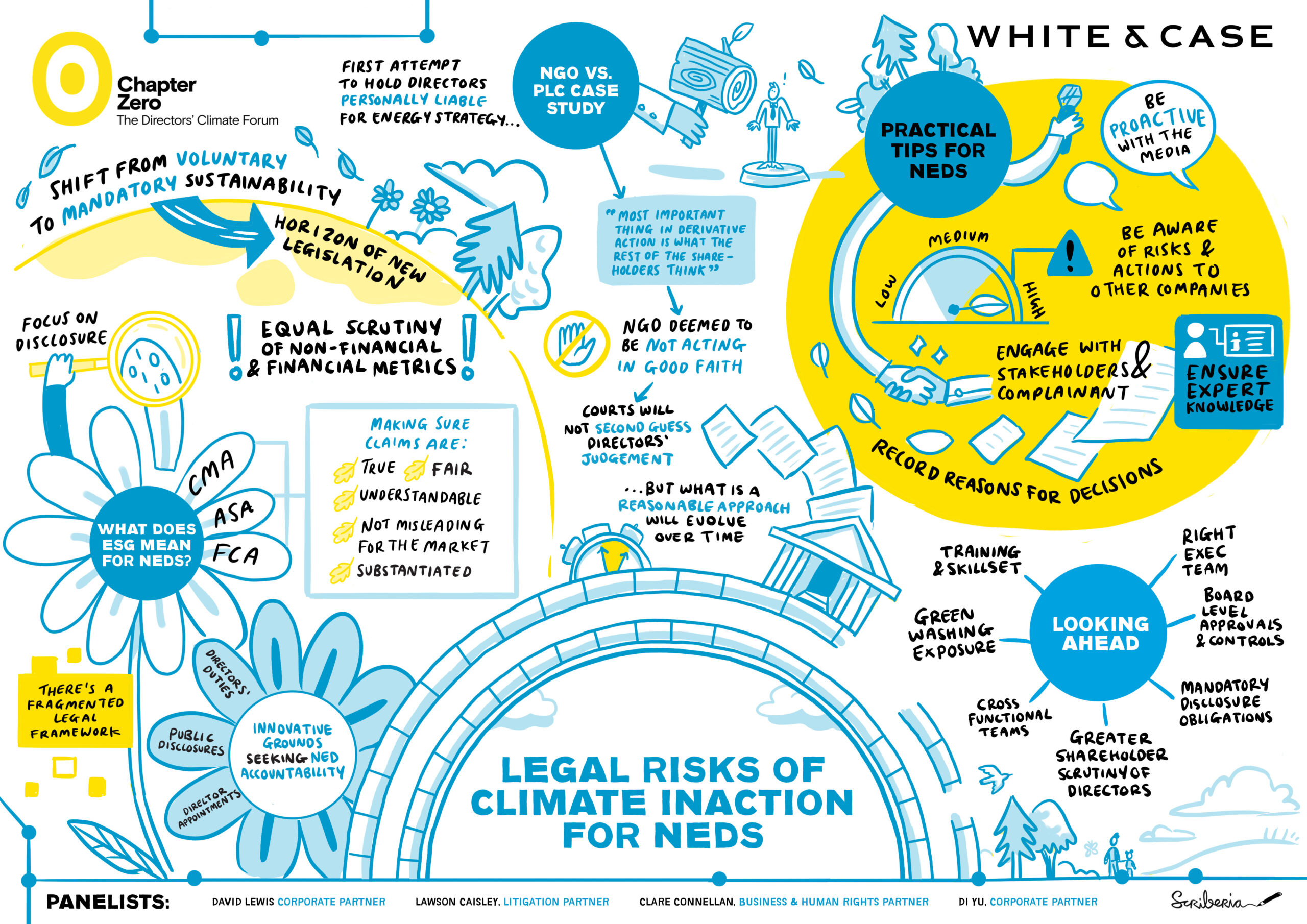

Here is a visual summary of the presentation and discussions from the event, as depicted by Scriberia (click on the image to enlarge it):

Discussion summary

- While the risk of successful litigation on the basis of climate inaction is far from certain, there is a growing risk of claims being threatened/commenced, and a real risk of both legislative and regulatory change.

- ESG issues are becoming increasingly prominent in a wider range of sectors, not only energy and extractives but also financial institutions, retail and consumer.

- Full supply chain transparency is an emerging requirement with an expectation of equal scrutiny of non-financial and financial metrics.

- The legal framework for ESG claims is fragmented, but an increased focus has led to innovative legal challenges and increased attention from institutional shareholders and regulators on board responsibilities.

Ensure board skills and experience to meet and manage risks

- Be aware of greenwashing exposure or greenhushing

- Confirm mandatory disclosure obligations are respected and the non-financial metrics are as robustly supportable as financial metrics

- Ensure green claims meet regulators’ guidance and standards

- Ensure effective board level approvals and controls over green claims and sustainability targets

- Check training and skillsets of responsible management to ensure effective scrutiny of green claims and sustainability targets

- Maintain cross-functional teams to minimise risk of green claims and set and monitor sustainability targets

- Ensure board can properly assess the risk posed to their company by climate change as well as the impact on climate change of their company.

Avoiding / dealing with shareholder complaints

- Ongoing monitoring of market developments / targeting of boards

- Ensure appropriate expertise on board

- Engage with complainants

- Engage with other shareholders – not only at AGM

- Ensure there is a thorough analysis and consideration of issues raised

- Record reasons for decisions / conclusions

- Engage with analysts / media