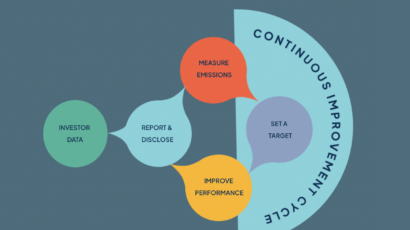

Ensure Accountability

- operational oversight

- cultural alignment

- and rigorous monitoring and reporting.

Featured content

Navigating the climate disclosure landscape

This explainer provides an overview of the evolving and interconnected landscape of climate targets, metrics, reporting standards and frameworks for non-executive directors (NEDs).

From pledge to progress: how businesses can take transformational ESG action

Chapter Zero Fellow, Patricia Rodrigues Jenner, shares her perspective and experience on how leaders can begin the tough work required to achieve sustainability goals.

Scope emissions explained

Knowing where your company’s emissions are made is an important step in setting robust and measurable targets. We explain Scope emissions and how to define them.

How can board directors prepare for the upcoming TNFD framework release?

As stewards of their organisations, board directors will benefit from understanding the Taskforce on Nature-related Financial Disclosures (TNFD) framework ahead of its official launch in September 2023, and its implications for the organisations they represent. This Climate Governance Initiative briefing provides guidance to board directors on how to prepare for the incoming framework.

SEC climate disclosure briefing for Board directors

This briefing, produced by the Climate Governance Initiative, explores and discusses the context of the proposed SEC climate disclosure rule, the current status and likely next steps, and provides key questions for board directors to ask their boards in relation to it.

Blog articles

View all

Five tips for your annual reports

With extensive expertise chairing multiple FTSE350 boards, as an investor and pension fund trustee, Chapter Zero Supporting Chair Sarah Bates shares her top five tips for this annual reporting season.

United Nations: Finance & Justice

In many respects, climate finance, when it is sufficient and invested in the right ways, is a path to climate justice. How can it happen? The UN Secretary-General's Acceleration Agenda for 2023 outlines six critical actions for governments, businesses and financial leaders.

Case studies

View all

Metro Pacific Investments Corporation (MPIC): A holistic approach to finance, risk, climate and sustainability

This Climate Governance Initiative case study looks at Metro Pacific Investments Corporation (MPIC), a leading infrastructure investment company in the Philippines, viewing the challenges of a developing nation like the Philippines as an opportunity for bold climate leadership.

SSE: Committed to a just transition to a decarbonised energy sector

The We Mean Business Coalition looks at SSE’s commitment to a just transition to a decarbonised energy sector.

Explainers

View all

The Corporate Supermap: Culture leadership insights with Tina Mavraki

Published 19 September 2024 by the Centre for Climate Engagement, Tina Mavraki's leadership insight outlines how positive culture contributes to net zero, and analyses why leadership should set their sights on connecting organisational behaviour with corporate strategy infrastructure.

Audit Committee Dialogue: Integrating nature-related financial disclosures

In partnership with Accounting for Sustainability (A4S), Chapter Zero recently held the third session of its series of roundtables for Audit Committee chairs and members to explore the emerging requirements for audit committees in effectively driving action on climate and nature from the boardroom.

Audit Committee Dialogue Summary: Transition planning and the changing sustainability reporting landscape

Chapter Zero recently organised a series of two roundtables for Audit Committee Chairs and members in partnership with Accounting for Sustainability (A4S) to explore forward planning, effective communication, and an understanding of emerging requirements for Audit Committees to drive climate action on boards. With expert input from A4S, the second session focused on transition planning and the changing sustainability reporting landscape. These are two topics that are critical for Audit Committees to keep ahead of, and you can find the key takeaways from the second session below.

News

View all

IASB proposes illustrative examples to improve reporting of climate-related and other uncertainties in financial statements

This 2024 article from the International Accounting Standards Board, written 31 July 2024, proposes examples of improved reporting of climate-related and other uncertainties in financial statements.

Reports

View all

South Pole 2025 net zero report

Published 10 April 2025, South Pole's net zero 2025 report surveyed 350 financial institutions to better understand how businesses are progressing towards their targets.

Analysis of 2022 UK Company Annual Reports

A UKEB analysis of 2022 UK Company Annual Reports: A Study in Connectivity.

Achieving a circular economy: using data-sharing tools, like the Digital Product Passport

The world’s material circularity currently stands at 7.2% - having decreased from the 8.6% material circularity recorded for 2020 and the 9.1% for 2018. This WBCSD research provides a practical example of the data flows that may exist and be utilized to enable a circular economy across four sectors.

Toolkits

View all

Change Management Toolkit: Executive Summary

Executive summary for the Change Management Toolkit, created with Eden McCallum. This toolkit is designed to help non-executive directors educate themselves on the business implications of climate change.

Videos

View all

Watch: Sustainability Reporting- A perspective from the FCA

Watch this webinar from Chapter Zero and the Deloitte Academy, where we provided an update on sustainability reporting in the UK in March 2025, and the Director of Sustainable Finance at the Financial Conduct Authority shared a perspective on the key focus areas for boards in 2025.

Watch: A focus on your year-end reporting

Watch Chapter Zero and the Deloitte Academy's discussion of the latest developments and best practice in relation to UK reporting, including sustainability and climate reporting requirements.

Watch: Taskforce on Nature-related Financial Disclosures

Watch Deloitte's discussion into the TNFD disclosure recommendations, including how they may be used to inform future standard setting and regulations, alongside considering the actions companies can take now to integrate nature and biodiversity into decision-making and reporting.

Events

View all

Taskforce on Nature-related Financial Disclosures

In this webinar, we will be joined by Emily McKenzie, Technical Director at TNFD Secretariat, and Sue Lloyd, Vice-Chair of the International Sustainability Standards Board, to discuss the Taskforce on Nature-related Financial Disclosures' (TNFD) recommendations, including how they may be used to inform future standard setting and regulations. We will also consider the actions companies can take now to integrate nature and biodiversity into decision-making and reporting.

Climate Dialogue: Audit Committees

Join us for a session exclusively for Audit Committee Chairs and Members, in collaboration with Accounting for Sustainability (A4S) to explore transition planning and get an understanding of emerging requirements and changing regulations for Audit Committees to drive climate action on boards.

Sustainability and climate reporting: A focus on your year-end reports

In this webinar, in collaboration with the Deloitte Academy, we will discuss the latest developments and best practice in relation to UK and Global reporting standards for sustainability and climate and when they will be applicable to UK organisations.