Legal considerations for transition planning: Strategic climate planning

Laurel Powers-Freeling, who sits on the Chapter Zero board, opened the session by emphasising Chapter Zero’s strategic focus on transition planning, and the growth of its networks of directors committed to embedding transition thinking within their businesses. Jake Reynolds, Head of Client Sustainability at Freshfields, highlighted the importance of legal expertise in progressing transition planning towards meaningful business transformation. This reflects growing industry expectations for boards and directors to not only understand what action is required to deliver the Paris ambition, but to actively guide the implementation of future-fit transition plans.

Governance

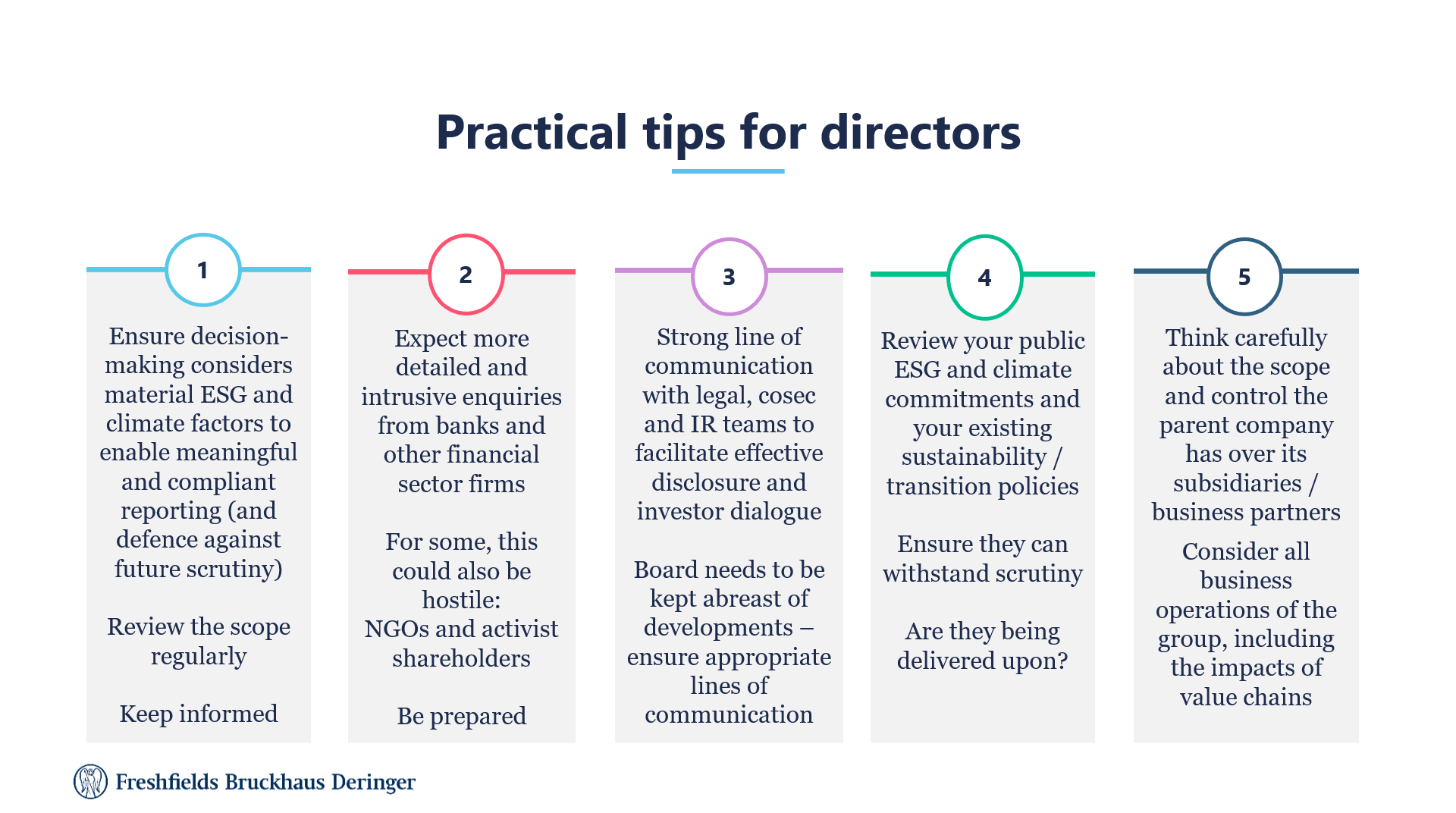

Good climate governance requires effective management of legal pressures. Following discussion of regulation, focus turned to the importance of governance structures in both embedding meaningful change and mitigating legal risks. With reference to directors’ duties (Sections 172 and 174 of the Companies Act 2006) and ‘do no significant harm’ principles present in the EU’s new sustainable finance regimes, it was outlined how in order to claim to be sustainable, businesses must also demonstrate ‘good governance’. Moving on from transparency and disclosure obligations, Directors in attendance heard that the EU’s Corporate Sustainability Due Diligence Directive, if passed, will introduce direct duties on organisations and directors to actively diligence and manage ESG risk in the value chain. This will have material implications for companies’ governance practices.

Parent company liability was identified as another key legal risk. As the regulatory focus continues to shift towards integrating sustainability across supply chains and value chains, it is imperative that boards take stock of their vulnerabilities to litigation and how to address these gaps within existing commercial relationships. For subsidiaries, identifying these vulnerabilities may bring to light questions about the scope and level of control a parent company has, and whether this should be reevaluated.

Although derivative actions such as the claim brought against Shell by ClientEarth have been unsuccessful in England, the law and science in this area are constantly moving thus directors must ensure resilience to similar legal actions in the future (for example, the management of the Polish energy company Enea is suing former directors and its insurer for lack of due diligence over a coal-powered plant investment that gave rise to material losses for the company). The direction of travel indicates increased scrutiny of directors and how sustainability relates to their fiduciary duties. The likelihood of more intrusive enquiries into ESG practices is increasing, and companies should be appropriately equipped with defensible positions to stand behind. In summary, good governance should be strategically prioritised.

Embedding innovation into transition planning and financing

Following the overview of key regulatory and governance considerations, insight was provided into M&A’s role in the 21st Century’s most significant industrial challenge - the global energy transition to net zero.

The strategic role of M&A was demonstrated through case studies, including Tenaga Nasional Berhad’s acquisition of an interest in EDF’s Blythe Offshore Wind Farm, a renewable energy technology demonstration and innovation project. Similarly, General Atlantic’s BeyondNetZero fund’s investment in offshore wind energy services business Venterra Group points to the potential for M&A strategies to advance climate goals. Leveraging M&A as a mechanism for fostering climate innovation may help disrupt the lock-in effect many industries face, in which entrenched technologies can block the adoption of new technologies and the acceleration of decarbonisation.

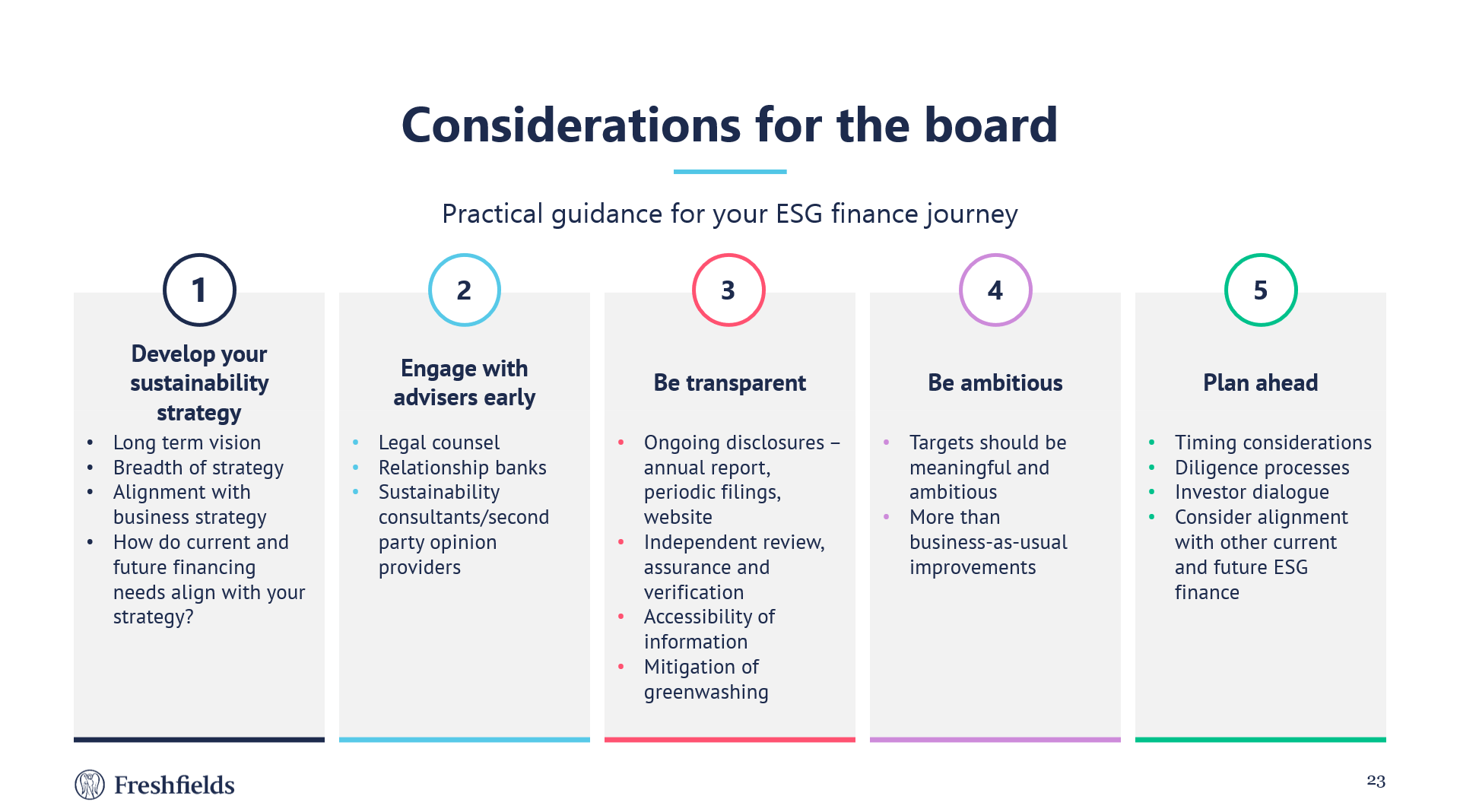

As these examples of supporting energy transitioning through M&A show, there is a compelling need and significant opportunity to finance innovative business models. Finance is the defining factor in not only M&A but many other material business decisions, with finance being critical for businesses navigating the legal risk landscape. With an increasing focus on greening financial markets, there is a multitude of financial products and tools to support corporate sustainability goals. Boards need to navigate the distinctions between green, social, sustainability and sustainability-linked bonds and loans, to help determine the most suitable financial instruments to support companies’ climate ambitions. Moreover, there should be a clear understanding of the targets and KPIs associated with each type of bond or loan to ensure that, when implemented, they can be properly measured, monitored, and reported on to demonstrate adherence to the expectations made.

Transformational M&A in the boardroom: how should directors balance their duty to promote the financial success of the company with the imperative to address climate performance?

Having heard from the lawyers, Chapter Zero members were invited to participate in an interactive M&A case study exercise. For the purposes of the exercise, groups of attendees acted together as a board to consider a hypothetical M&A proposal. The case under consideration was proposed as an opportunity to deliver significant cost savings through geographical and operational consolidation, juxtaposed with a number of climate-related concerns that required further deliberation.

Attendees were tasked with agreeing on whether the acquisition would be a good decision. The issues dealt with included:

- Due diligence processes: A primary concern in this M&A case was uncertainty around the counterparty’s existing governance structures and verifiability of climate performance. Participants spoke about how differing metrics and disclosure expectations, particularly in emerging markets, can be a challenge in terms of establishing alignment between parties. The greater the disparity in due diligence governance practices, the more difficult it becomes to align on wider transition priorities. The perceived risk of misalignment was seen as a cause for further assessment before reaching a decision.

- Capital feasibility: As discussed, access to finance is central to successful M&A outcomes. In their evaluation of the deal’s economics, attendees focused on determining whether the ambitions presented in the deal were achievable in light of existing capital facility sustainability-linked KPIs, considering the long-term business outlook for the merging parties. Maintaining investor confidence is also of great significance to transformational M&A and should be prioritised accordingly.

- Supply chain dynamics: One of the cost-saving efficiencies promoted in the deal was the use of the counterparty’s cheaper supply chain. However, it appeared that this relied on manufacturing in countries with high-emitting electricity grids. Attendees felt that this complicated the decision to move forward with the deal, as it posed legal risks including potential claims of greenwashing and potential future cost increases due to climate regulation, as well as reputational risk. Integration would require a reassessment of reciprocal supply chain dynamics, to identify how value drivers can be realigned towards strategic transition priorities.

- Integration planning: Attendees cautioned that decisions on this scale require extensive thinking and planning. Chapter Zero members saw the compatibility of corporate cultures to be a defining factor in integration. Despite the potential short-term impact on reputation, re-baselining to account for changes associated with the acquisition presents opportunities to rapid improvement, which could help raise a company’s standing in the long term.

In the ideal scenario, acquiring a market competitor who is underperforming on sustainability can have a positive sector-wide impact if climate-conscious changes are then implemented in the acquired business. Achieving transition at scale may require market leaders to work with so-called ‘brown assets,’ or those that are harder to decarbonise, to leverage their resources and facilitate broader industry transition. In these cases, a comprehensive understanding of the value drivers of each organisation is critical to maintaining reputational integrity while prioritising growth through transition.

This event summary was developed in collaboration with the Centre for Climate Engagement at Hughes Hall.

Read more

Explore the key takeaways from the first session of this series which provided an overview of the interaction between climate change, legal issues and business, and focused on legacy risks to companies, including litigation, and how they can be mitigated.

Read the article